The Future of Industrial Mobility and Autonomy

Explore how industrial mobility advancements are transforming operations, boosting efficiency, safety, and scalability across industries.

Learn all you need to know about industrial AV deployments across all sectors, and why it's expected to grow to $300 billion by the end of this decade.

Following two decades of research, development, and beta testing, autonomous industrial vehicles have grown beyond their startup phase, and have risen to become an industry necessity at dizzying speeds. Having proven the efficacy of the complex sensor technology and AI software that power autonomous vehicles, autonomous vehicle (AV) manufacturers are now focused on producing more specialized, refined vehicles, and ramping up production to meet demand.

By the simplest definition, industrial automation is the process of increasing production with reduced human intervention, greater efficiency, and dependability. In an era of increasing demand, exponentially complex supply chains, and labor shortages, the decision to automate conventional processes becomes a critical one.

Thus, the Industrial Automation Market is expected to reach $306.2 billion by 2027, according to Meticulous Market Research, Inc. This rapid surge of industrial autonomy has facilitated profound changes in workflow, profit pools and value chains, ushering global industries across the board into an age of unprecedented transparency, flexibility, scalability and efficiency. McKinsey Analytics estimates the manufacture of autonomous industrial vehicles has increased 11.6% in the U.S. in the first half of 2022.

The implementation of autonomy yields key benefits with immediate results, increasing profitability, scalability, adaptability, and safety — such that early adopters are carving out a competitive advantage and setting new industry process standards.

In short, the technological fabric that underpins the very nature of how businesses operate globally has shifted toward Autonomy, and this shift is gaining steady momentum.

Most of us have heard the term Industry 4.0, or the Fourth Industrial Revolution. Specifically, Industry 4.0 refers to the giant leap in productivity and throughput that is being facilitated via the use of autonomous industrial vehicles, robotics, machine learning, and connected devices.

The use of autonomous mobile robots (AMRs) is increasing steadily, as businesses spanning the supply chain scramble to respond to labor shortages, the eCommerce boom, and shifting consumer demand for faster, more flexible deliveries.

Manufacturers in sectors such as consumer electronics and automobile manufacturing have made the move to assembly line robotics, autonomous guided vehicles for material transport, and IoT sensors to track thousands of objects in real time, from plant to final destination.

In addition to vehicle sensors, IoT sensors track theft, breakage, impact, location, leaks, and temperature in real time. This allows for the timely intervention and recovery to prevent losses and production imperfections before they happen, a dramatic improvement to the most common supply chain problems. The confluence of AVs and IoT offer seamless supply chain transparency and improved efficiency, giving rise to the term 'connected warehouse'.

As manufacturers steadily increase their investment in automation to overcome the inefficiencies and scalability challenges of conventional manufacturing, the demand for industrial automation continues to grow in response. We will soon reach the point, if we haven’t already, whereby it will be impossible to remain competitive without the adoption of automation, especially in industries with thin margins.

Industrial automation is much more than just a new line of gadgets that yield small, incremental improvements...companies can literally transform their organization to new levels of productivity. Let’s briefly touch upon some of the ways industrial autonomy transforms efficiency and addresses common challenges.

1. Addressing Labor Shortages

Labor shortages rank in the top 4 greatest challenges facing manufacturing, transportation, and supply chain leaders, with over 50% citing employee retention as their single biggest challenge. When we consider that it takes 30-60 days to fill an open position, plus additional time for training and onboarding, the enormous impact of employee hiring and retention on productivity becomes clear. It is estimated that by 2030, the impact of manufacturing jobs that remain unfilled could cost the US economy more than $1 trillion.

Autonomous vehicles can address this issue head-on by taking on repetitive tasks and transport routes, freeing up an estimated 30%-50% of a skilled worker’s time. Companies can accommodate increased production with fewer labor resources, while shifting workers’ focus to higher- value tasks.

2. Boredom & Error

Relieving skilled workers from monotonous tasks, such as driving goods around huge facilities, contributes more benefit than just freeing up their time. Tedium should be taken very seriously...it is associated with errors, safety issues, lower morale, and employee churn. A study by Vanson Bourne found that a whopping 23% of unplanned downtime is caused by human error alone.

3. Efficiency: Increased Production with Decreased Costs

By taking on redundant tasks, coupled with their ability to operate continuously, autonomous vehicles improve throughput, allowing companies to reap significant operational efficiency gains. A recent report from Sapio Research, “Automation for Intralogistics”, revealed key results after implementing automation were 48% improvement in productivity, and 42% decrease in operating costs.

4. Agility

AVs offer the ability to move goods with greater flexibility. Previously, ma3n.ufacturing depended on transport methods such as fixed conveyance to move goods; however, conveyance is costly and lacks agility. By contrast, redesigning a vehicle’s route in a facility, or choosing from a variety of saved missions, takes only minutes in AV software.

In less predictable environments where conveyance was not ideal, manufacturers relied on skilled human workers to drive goods; another job far more suited for AMRs (autonomous mobile robots).

AVs not only allow for agile route and workflow changes, they are also instrumental shifts toward decentralized manufacturing.

5. Scalability

As AVs free up skilled workers’ time, organizations can accommodate considerable growth without having to spend more on additional labor resources. Restructuring workflow and reprogramming routes are simple processes with autonomous industrial vehicles, which can be executed in a matter of minutes. This allows organizations to rapidly adapt to increased demand and changes in logistics flows.

6. Safety Considerations

Safety is a major consideration leading companies to shift to AGVs and AMRs. The US Bureau of Labor Statistics states that from 2011 to 2017, 614 workers lost their lives in forklift related incidents. Moreover, the organization further estimates 7,000 nonfatal injuries each year, triggering invasive safety inspections and expensive workers’ comp claims.

The average industrial accident costs $42,000, not including associated production losses, and the average American warehouse experiences 9 accidents per year. The total cost of preventable workplace injuries in the US in 2019 was $171 billion.

In stark contrast, the Material Handling Institute (MHI) reports zero known AGV- related injuries.

Of course, any warehouse, site, or plant manager knows that a sizable chunk of safety violations do not result in injury; a safety issue may be as simple as a vehicle’s mirror getting clipped while turning a tight corner. Nonetheless, these minor occurrences require incident reports and slow the day’s production. We hear you barking, Big Dog.

As we’ll discuss in later sections, industries across the board recognize the immediate value of improved safety that autonomous industrial vehicles provide when humans aren’t involved, such as in dangerous environments or in the handling of hazardous materials.

While manufacturing has been identified as a key driver of growth for the industrial autonomy market, we have identified major industries currently employing and relying on industrial autonomy, which will also fuel AV industry growth. While the list is far too extensive to adequately represent, here are some key industries that are utilizing AV, driving growth, and furthering AV innovation:

1. Agriculture: The growing use of self-driving and IoT technology, such as autonomous tractors, in the agriculture industry has led to the terms Agriculture 4.0, Digital Farming, or Smart Farming, much in the way manufacturing is now experiencing Industry 4.0. Self-driving tractors take up the 8-12 hours/day of driving that used to be spent by humans. Vehicles are viewable, programmable and controllable via an app, and also offer considerable safety benefits.

An estimated 15% of US farmers are using IoT and self-driving tech on 250,000 farms. It is estimated that IoT and self-driving technology has the ability to advance productivity by up to 70% by 2050. This is critical, since it is estimated that food production must increase by 60% by 2050 due to population expansion. Agricultural robotics is estimated to grow from a $3 billion to $12 billion industry by 2026.

2. Aerospace: While autonomous flight may be a reality in our foreseeable future, the aerospace industry is currently using autonomous mobile robots for a wide variety of manufacturing uses, such as unloading trailers,

warehouse transportation, tugger and trolley replacement, and pick-and- place. Rapid growth of utilization of autonomy is predicted, as a result of cost, labor, and time savings.

3. Construction: In addition to AVs for material transport, the use of autonomous bull dozers and excavators continues to grow. The global construction robotics market is expected to reach $7.9 billion by 2027, according to Allied Research.

4. Consumer Goods: Perhaps this topic warrants its own paper. In addition to warehouse and transportation robots, retailers are ramping up efforts for autonomous delivery vehicles, and are currently utilizing autonomous cleaning robots.

5. Chemicals: The chemical industry was an early-adopter of robotics and sensor technology, as safety is a major concern in chemical handling. AGVs are used to transport raw and finished materials, and to inspect hazardous or hard-to- reach areas, resulting in a safer, more productive operation.

6. Dairy: The dairy industry has been relying on a multitude of sensor technologies to monitor herd conditions as well as product. With labor accounting for more than 20% of production costs, the industry is now employing autonomous vehicles to roam pastures and monitor herd health and soil conditions, as well as autonomous grass harvesters and feeders.

7. Defense: The Defense industry uses autonomous vehicles for hazardous environments and unmanned scout missions, with both on and off-road capabilities. Unmanned Ground Vehicles (UGVs), also known as “Bots on the Ground”, are poised to not only impact, but even revolutionize land operations.

8. Food & Beverage: AVs have established themselves in food & beverage plants for material and product transport, as key benefits include reduced operational costs, faster ROI, reduced risk of spoilage, and reduced item damage.

9. Logistics and Supply Chain: Warehouse transport aside, the last-mile phase of delivery has historically been challenging. Retailers are looking to AVs to surmount this and other rifts in supply chains. With the use of robust 5G networks, natural language processing, sensor technology, and AI, AVs can bring reliability, speed and efficiency to last-mile delivery.

10. Mining: The Mining industry is an early adopter of autonomous dump trucks, drills, and vehicles to transport ore. As with other industries, the benefits of safer, productive, reliable multi-shift material transport are fundamental. Additionally, the move away from gas-powered vehicles provides a healthier environment for workers, with less need for ventilation. The autonomous mining equipment industry is expected grow from $2.28 billion in 2020 to $3.44 billion in 2025 at a compound annual growth rate of 5%.

11. Meat Processing: The meat industry is switching over from conventional forklifts to autonomous ones, which load AGVs that transport product across the plant to areas such as packaging, refrigeration, and loading docks. Considering the perishability of meat products, the efficiency that autonomy provides is a key consideration. In addition to warehouse transport applications, the meat (and other types of food) industry is using IoT sensors to monitor temperature during transport.

12. Metals: In sectors such as the aluminum industry, Hot Metal Carriers (HMCs), autonomously handle and transport tons of molten metal from the smelter to the casting shed, where it is then converted to block products. Smaller AVs then transport block products to other plant areas.

13. Oil & Gas: The Oil & Gas industry is currently utilizing autonomous drones, autonomous snakes, above ground AVs, and underwater autonomous vehicles for leak detection, pipe inspection, and security purposes. According to a recent World Economic Forum report, robotic land and underwater vehicles and drones are expected to be the highest adopted technologies in the oil and gas industry in the next 5 years.

14. Paper & Pulp: From forestry to pulp and paper production, AVs are being employed at every step of material transport in the paper industry. According to a McKinsey report, paper and pulp companies utilizing autonomy have seen productivity gains of 8 to 10 percent, and decreased costs ranging from 15%-20%. For the industry, this represents a $4 billion to $6 billion opportunity.

15. Pharmaceuticals: Pharma is highly automated, from employing robots to fill and pack with high accuracy and efficiency, to using AVs to transport goods along manufacturing routes. Pharmaceutical companies have also begun using autonomous vehicles for product delivery.

16. Rescue: According to a report by Market Research Future, the Search and Rescue Robot market is projected to grow at a compound annual growth rate of 18.2% by 2027. Autonomous vehicles can traverse hazardous conditions, access hard-to-reach places, and send camera and sensor data to communicate findings with rescue workers.

17. Snow Removal: Driverless snow plows are already in use in countries such as Sweden and Canada. Minnesota is currently testing similar vehicles with advanced lane edge tracking in low-visibility, high-wind scenarios. California’s CALTRANS is in development of autonomous snow blowers for use on hazardous mountain roads.

18. Street Cleaning: Street Cleaning, a $1.9 Billion industry in the US, has begun development of fully autonomous, electric street sweeping robots, saving labor costs and reducing dependence on fossil fuels.

19. Transportation: Driverless trains, buses and shuttles, are in various stages of use and development, alongside advanced driver-assist and collision prevention technology. According to a report from Fortune Business Insights, the worldwide self-driving car market was estimated at $1.45 billion in 2020, and is forecasted to reach $11.03 billion by 2028.

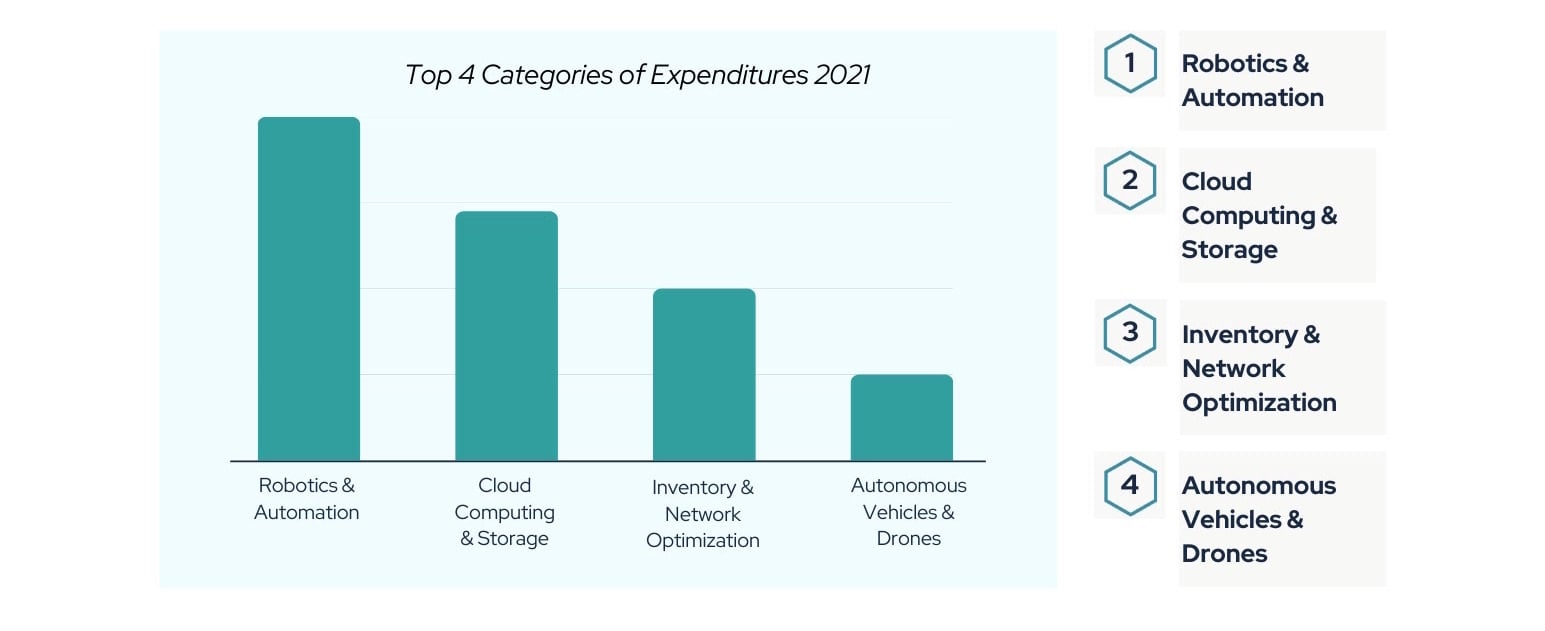

We’ve explored how industries are employing industrial autonomy, but it’s also important to note the dramatic changes in spending categories related to industrial autonomy.

Taking Supply Chain as an example, MHI Deloitte’s 2021 Industry Report noted the ‘Spend to Thrive’ trend whereby companies have shifted their expenditures over the last decade in favor of scalable digital technologies.

The top 4 categories of expenditures of 2021 are identified in order as:

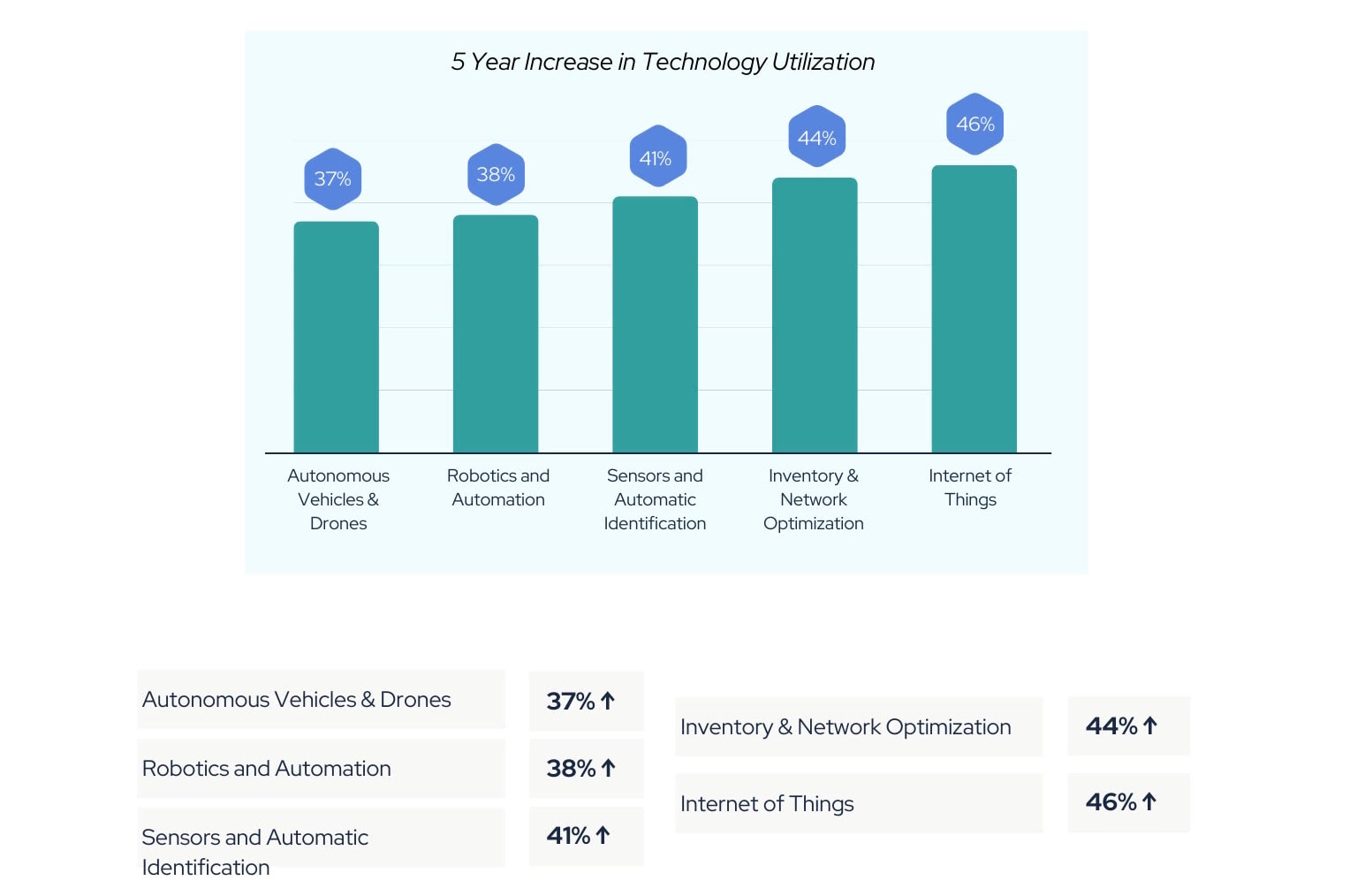

The same study also predicted the increased technology utilization in 5 years as follows:

The same study also predicted the increased technology utilization in 5 years as follows:

Decision Making & Calculating ROI:

Opportunity Cost:

Approximately 12% of US manufacturers have already integrated autonomous vehicles into their workflows. The majority of these early adopters attributed cost savings as their number one reason for adopting autonomy. Ironically, those who haven’t yet embraced autonomy cite cost as the main barrier to adoption.

This behavior alerts us to the trend in perception whereby any new technology must be prohibitively costly (perhaps harkening back to the days of cumbersome installations of fixed conveyance), however, the reality is that failure to adopt at this critical juncture will make an organization less competitive, less scalable, less profitable, and grossly underprepared for labor shortages and market shifts. While this opportunity cost should be a key consideration, it is often left out of the equation at the decision-making stage. The cost of doing nothing is not trivial, especially with current labor challenges and increased demand.

RAAS vs. Capital Expenditure:

The Robotics-as-a-Service model is an improvement over the outright purchase of a robot, as an AGV is much more than just a standalone unit, it is a complete solution. With RaaS as a monthly cost, we include the maintenance of all components of the system as a whole. RaaS allows for the expenditure to be categorized as an operational expense, vs. a capital expenditure that would amortize costs year over year, allowing us a clearer, faster ROI picture. Monthly RaaS costs are all-inclusive, and therefore predictable, with no need for additional capital investment cycles.

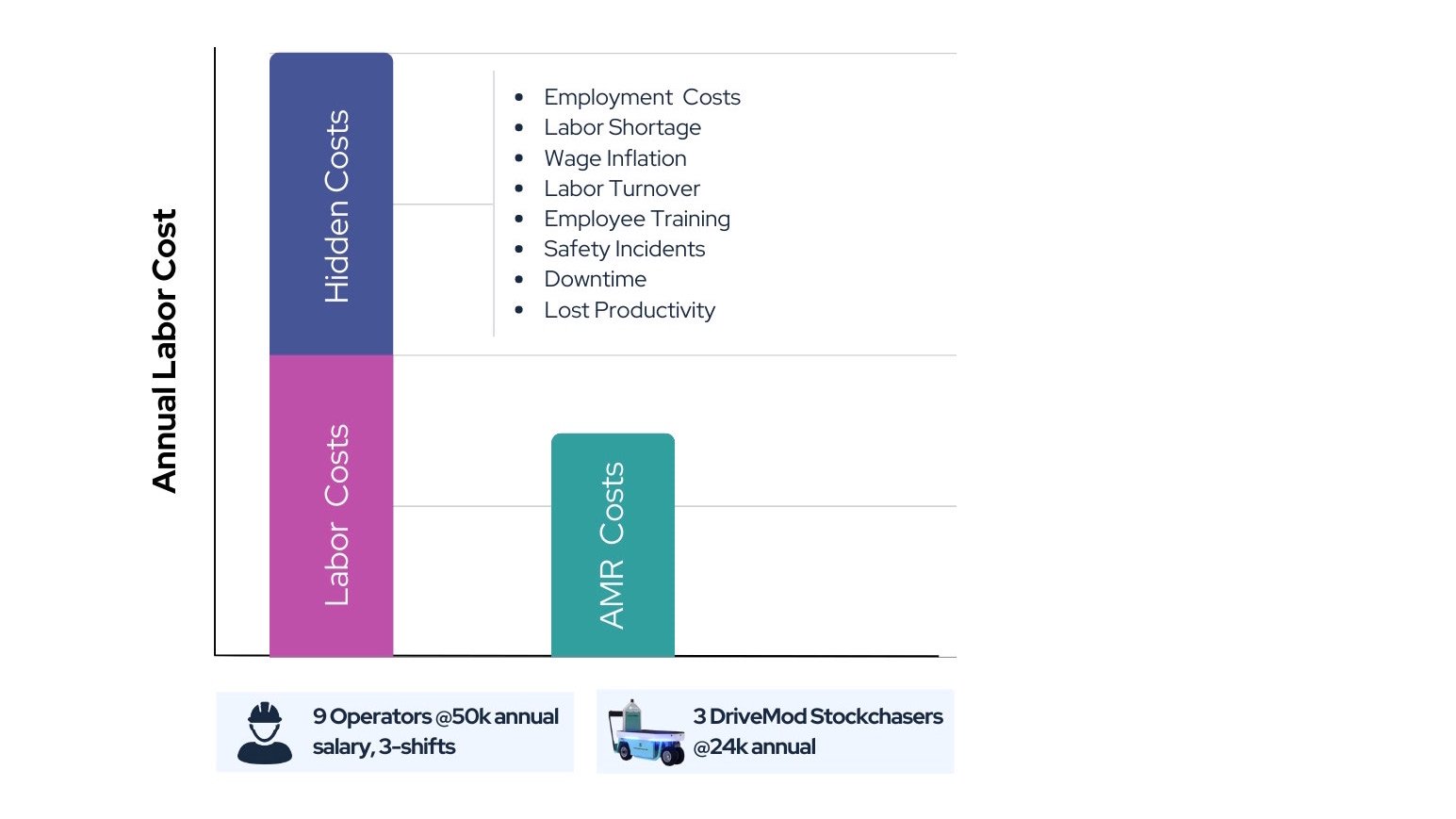

The Hidden Cost of Labor:

The 'hidden' costs of hiring, retaining, and even firing employees should not be forgotten when weighing the returns on expenditures for productivity solutions.

These frequently overlooked costs consist of employment costs (benefits, sick days, insurance and 401k contributions), labor shortages, wage inflation, labor turnover, training costs, lost productivity and downtime, as well as safety incidents.

Basic ROI Calculations:

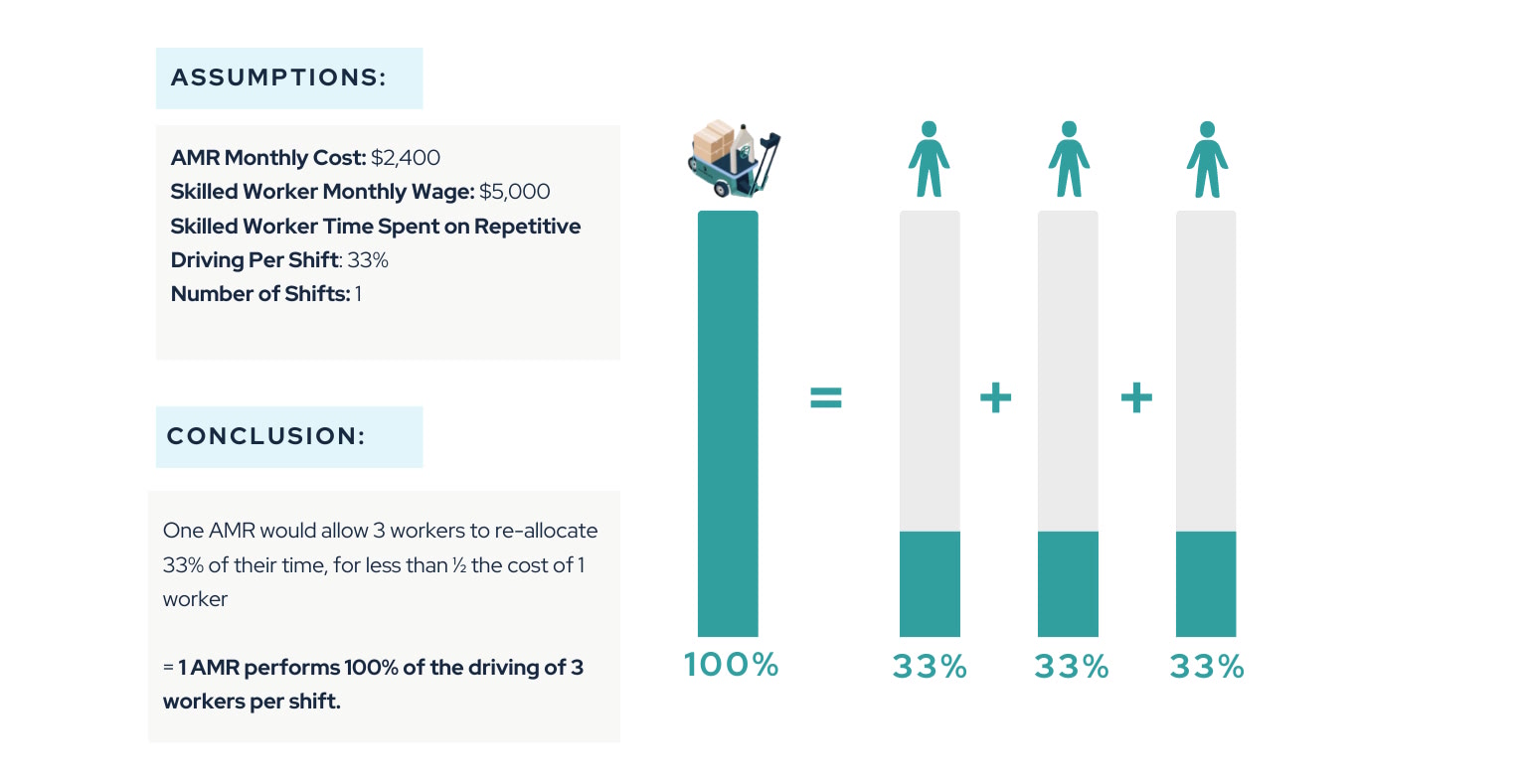

While autonomous vehicles have risen to the status of industry necessity, the industry is still too new to have compiled precise year-over-year cost efficiency and ROI numbers. Without the ability to crunch a decade of cost effectiveness metrics, we can instead approach the topic with formulas that calculate autonomous vehicle ROI based on vehicle costs, percentage of workers' time freed up by AVs, and skilled worker salary. For more in-depth numbers, we should consider variables such as safety-related costs, opportunity cost, improved efficiency of human workers, turnover, and training costs of human workers.

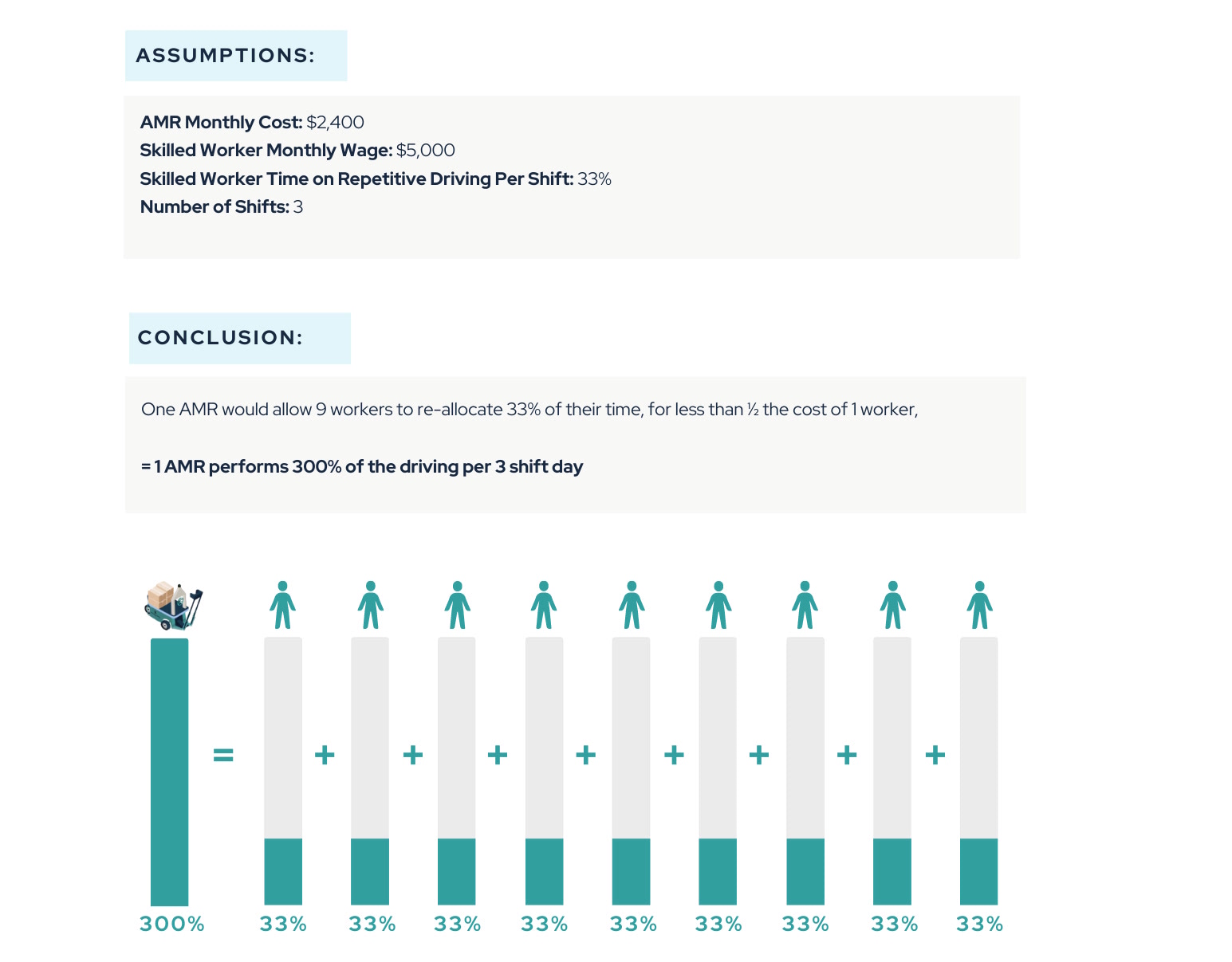

While our DriveMod Stockchasers cost less than the average worker salary, for simplicity, let’s assume a worker’s monthly wage and cost of an AV are the same.

Multi-Shift Operations See Faster ROI

It’s important to note that these ROI gains double or triple in facilities that have 2 or 3 shifts per day. If the cost of one AV equals the average monthly salary of one shift worker, but the robot is able to work 2 or 3 shifts per day, the returns are reaped exponentially faster.

Basic ROI Calculation:

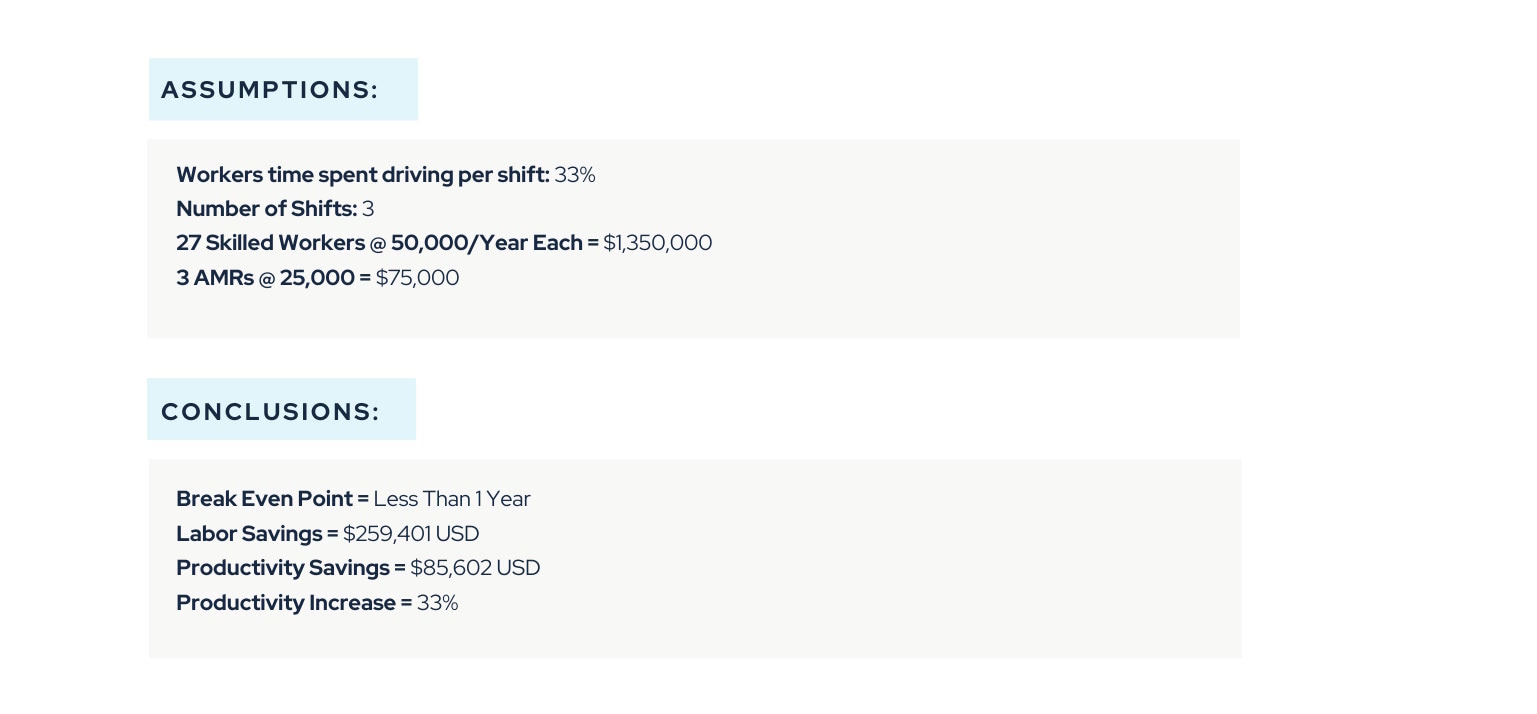

Using the scenario of each worker spending 33% of their time driving, and the plant having 3 shifts, let’s examine costs on an annual basis to approach ROI numbers.

In determining overall ROI, it bears repeating that labor and robot costs are not the only factors, but rather, only the first inputs in a complex calculation that includes workflow, labor rates, hours per shift, shifts per day, opportunity cost, and HR costs such as turnover, training, and benefits. Organizations should also weigh their costs of safety incidents against the cost of an AV.

While the above scenarios allow us to approach the topic of ROI, they are but a starting point.

For those who wish to go deeper by factoring in custom labor rates, shifts, hours per shift, throughput, and workflow, etc., we have established the necessary formulas and and variables to help you determine payback period and rate of

return based on your company's unique needs. Contact our Sales Team to achieve accurate, in-depth figures based on your unique scenario.

Additionally, we offer this web-based ROI Calculator to provide you with basic ROI figures based on labor rate, hours per shift, and shifts per day.

Formulas and calculators aside, Cyngn spent time with Global Logistics and Fulfillment, a leading West Coast distribution, fulfillment and third-party logistics services company where our vehicles were being deployed, and worked closely with the team and management to measure the effect of automation on labor costs and throughput. The results were dramatic, and almost immediate.

READ THE FULL CASE STUDY HERE.

An important concern among many when faced with a discussion of how many human salaries equal one robot, is that humans will be replaced by robots. With respect to autonomous industrial vehicles, this is clearly not the case. AVs take up mundane transport and patrolling duties, allowing workers greater productivity and safety, with higher rate of engagement (less chance of lowered morale and errors due to constant mundanity).

A recent study in Germany showed that the growth enabled by the application of autonomy in manufacturing and logistics will lead to an estimated 10% increase in employment, and demand for employees with training in IT and engineering may be even higher. While it is possible that automation may replace a percentage of unskilled laborers, it improves job creation numbers overall.

Don’t worry, Bob, you’re not being replaced.

The idea of replacing a fleet of industrial vehicles with autonomous ones may seem so gargantuan an endeavor as to prevent any further consideration on the matter. However, it is important to consider that an existing fleet can be easily retrofitted with AV technology at a fraction of the cost, and with faster implementation timelines than complete replacement.

Cyngn’s DriveMod Kit is a hardware sensor and AV software kit that converts your industrial vehicles to autonomous vehicles. Installation is fast and simple. Training is a breeze, as your DriveMod vehicle integrates smoothly into your existing workflow. The vehicle can be switched from autonomous to manual at the tap of a button.

Cyngn’s initial DriveMod installations were on Columbia’s Stockchasers. Contact us today to discuss adding DriveMod to your fleet of Stockchasers, or to see how DriveMod can be fitted to your existing industrial vehicles.

References:

Explore how industrial mobility advancements are transforming operations, boosting efficiency, safety, and scalability across industries.

Cyngn has found that there's an up to 50% cost premium to delaying your investment in industrial automation.

Early adopters of industrial AVs are gaining a competitive edge and setting new industry standards. Let's discover how 20 industries are using...