MENLO PARK, Calif., May 8, 2024 - Cyngn Inc. (the "Company" or "Cyngn") (Nasdaq: CYN) today announced its financial results for the fiscal first quarter ended March 31, 2024.

Recent Operating Highlights:

- Joined John Deere supply base

- Completed initial DriveMod Tugger deployment with Rivian

- Received a notice of allowance for a 20th U.S. patent, with 19 U.S. patents granted to-date

- RobotLAB joined the Cyngn Distributor Network, establishing an initial fleet for sale to end customers

- Released first video footage of AI-powered autonomous DriveMod Tugger by Motrec

- Renewed deployment contract with U.S. Continental; 4x gains in efficiency achieved

- Released automatic unhitching capabilities for industrial autonomous vehicles

- Announced that the next-gen DriveMod Kit will harness Nvidia AI computers

"During the first quarter, we continued the momentum we made during 2023, marked by rapid strides toward broad commercialization," said Lior Tal, Cyngn's CEO. "Our success is bolstered by the strength of our ecosystem partners, particularly with MCL Industries who is positioned to build DriveMod Kits at scale, and Motrec as an OEM partner with a long history of providing vehicles to our target markets in manufacturing and logistics."

"In my recent Business Update, I shed some light on the challenges of the industrial sales cycle—especially for a new, safety-critical technology that offers the competitive advantages that automation does to large enterprises. We remain confident in our ability to grow sales with our target customers, as was exemplified by our achievement of Deere selecting Cyngn to supply DriveMod Tuggers. Similarly, we are working with several customers to advance through the pilot purchase phase and unlock the fleet purchases that will establish our foundation for growth. In parallel, we continue to pursue new prospective customers. Advancements in our mapping and deployment tools have streamlined the demonstration phase that is often required early in the sales process to just a few days, which significantly lowers our customer acquisition costs and enables us to convert more customers to advanced sales discussions."

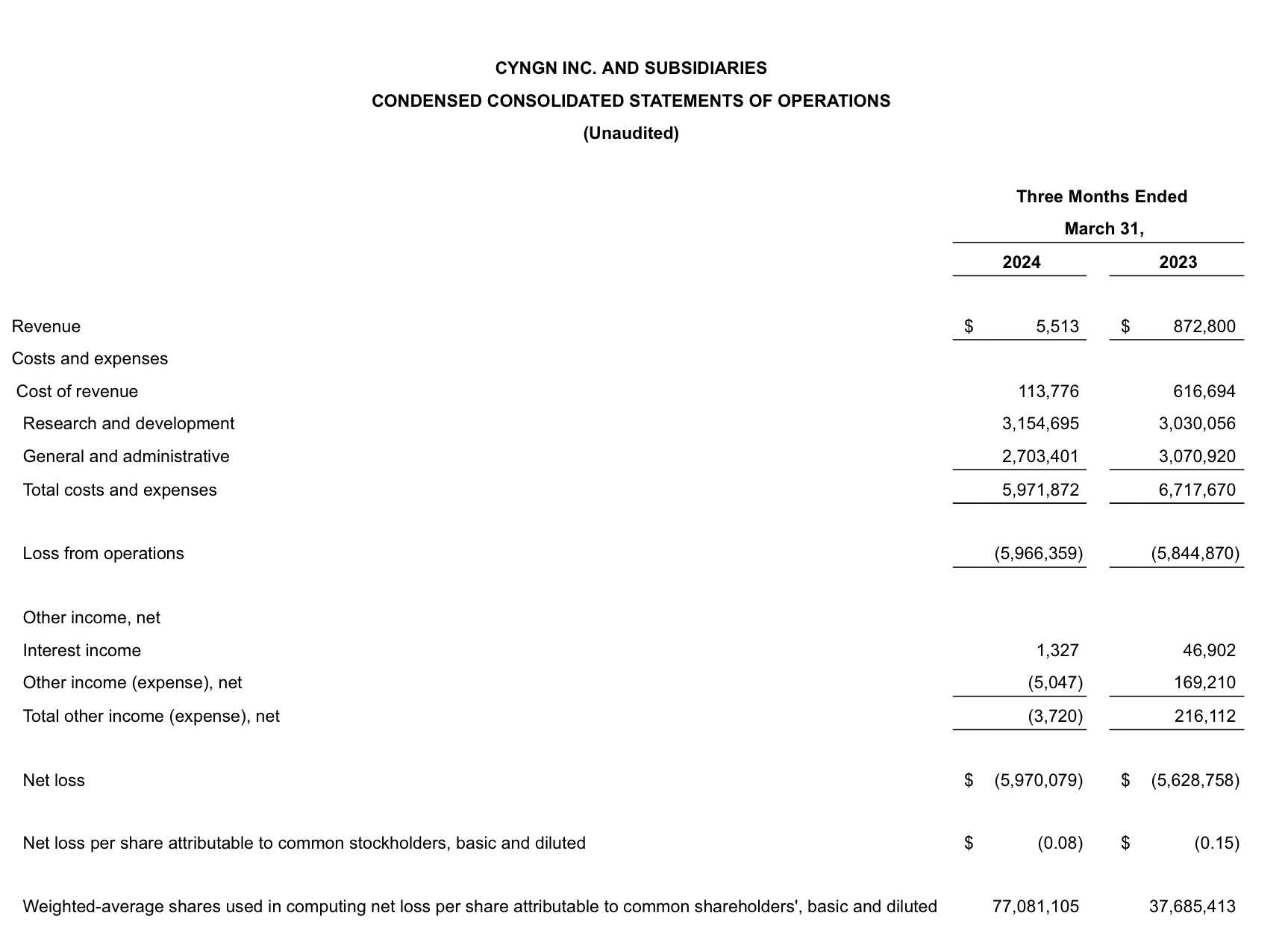

Q1 2024 Financial Review:

- First quarter revenue was $5.5 thousand compared to $872.8 thousand in the first quarter of 2023. First quarter 2024 revenue consisted of EAS software subscriptions from DriveMod Stock chaser vehicle deployments whereas prior year revenue was primarily the result of NRE contracts.

- Total costs and expenses in the first quarter were $6.0 million, down from $6.7 million in the first quarter of 2023. This decrease was primarily due to a $367.5 thousand reduction in G&A expenses and a $502.9 thousand decrease in cost of revenue, offset by an increase in R&D expenses of $124.6 thousand. The decrease in G&A expenses is due to a decrease in personnel costs, reduced premiums for Director and Office Liability Insurance, and savings on general office expenses. The decrease in cost of revenue is driven by the lower costs associated with EAS revenue compared to the NRE contracts in 2023. The increase in R&D expense was primarily driven by personnel costs incurred for additional engineering staff and external contractor costs to support the development of Cyngn's technology, offset by $102 thousand of capitalized software. Headcount at the end of the first quarter of 2024 was 80 versus 73 from the first quarter of 2023.

- Net loss for the first quarter was $(6.0) million compared to $(5.6) million in the corresponding quarter of 2023. First quarter 2024 net loss per share was $(0.08), based on basic and diluted weighted average shares outstanding of approximately 77.1 million in the quarter. This compares to a net loss per share of $(0.15) in the first quarter of 2023, based on approximately 37.7 million basic and diluted weighted average shares outstanding.

Balance Sheet Highlights:

Cyngn's cash and short-term investments at March 31, 2024 total $4.8 million compared to $8.2 million as of December 31, 2023. At the end of the same period, working capital was $4.6 million and total stockholders' equity was $8.0 million, as compared to year-end working capital of $7.4 million and total stockholders' equity of $10.6 million, respectively as of December 31, 2023. The Company had no debt as of March 31, 2024 and December 31, 2023.

Subsequent to March 31, 2024, Cyngn completed a $5.2 million public offering of its common stock. After giving effect of the net proceeds of $4.6 million, Cyngn's pro-forma cash and short-term investments, working capital, and total stockholders' equity was $9.4 million, $9.2 million and $12.6 million, respectively.

For more information on Cyngn, visit the "Investor Relations" page of the Company's website (https://investors.cyngn.com/).