MENLO PARK, Calif. Cyngn (or the “Company”) (NASDAQ: CYN), a developer of innovative autonomous driving software solutions for industrial and commercial enterprises, today announced its financial results for the fourth quarter and year ended December 31, 2021.

Recent Operating Highlights:

The following operational updates occurred subsequent to December 31, 2021:

- On January 10, 2022, Cyngn announced that Global Logistics and Fulfillment LLC (“GLF”), a premier warehousing and fulfillment provider, engaged the Company as its exclusive autonomous vehicle (“AV”) solutions provider following a successful 2021 pilot deployment at GLF’s Las Vegas distribution center, which included Cyngn’s AV technology integrated into the Stockchaser from Columbia Vehicle Group (“Columbia”).

- On January 18, 2022, Cyngn announced that, together with its partner Columbia, an electric vehicle manufacturer serving industrial and commercial environments, the Company began production of a fleet of autonomous Stockchasers powered by Cyngn’s Enterprise Autonomy Suite (“EAS”).

- On February 3, 2022, Cyngn and Greenland Technologies Holding Corporation (Nasdaq: GTEC) (“Greenland”), a technology developer and manufacturer of electric industrial vehicles and drivetrain systems for material handling machinery and vehicles, announced a strategic partnership whereby Cyngn will bring its self-driving vehicle capabilities to Greenland forklifts with its proprietary EAS enabling Greenland forklifts to switch easily between fully autonomous, manual, and remotely-controlled modes.

- On February 15, 2022, Cyngn announced the filing of a patent application for DriveMod Kit, a complete autonomy integration package designed to streamline the retrofitting of existing industrial vehicles or installation into newly manufactured vehicles. DriveMod Kit would enable faster and more cost-effective deployments of Cyngn’s industrial autonomy solutions, supporting scalability and rapid adoption of AV technologies by industrial and commercial enterprises.

Lior Tal, Chairman and CEO of Cyngn, stated, “In the months since October 2021 when Cyngn completed its IPO and became a public company, we have made notable progress toward productizing and commercializing EAS, remaining on schedule to begin scaled deployments in 2024 as previously disclosed. In January, GLF selected Cyngn as its exclusive AV solutions provider, marking a significant step forward in our partnership with Columbia. This was the result of a series of deployments in the second half of 2021, which included Cyngn’s AV technology integrated into Columbia’s Stockchaser. We look forward to additional deployments with GLF this year, especially as we partner to bring new facilities that are geared towards automation online. We also deepened our partnership with Columbia, kicking off production of autonomy-ready Stockchasers powered by EAS. This ensures that the best possible version of a Columbia Stockchaser is coming off the line, and it is ready for the integration of the DriveMod Kit for which we filed a patent application last month. Finally, we announced our partnership with Greenland where we will be embarking on our forklift automation effort. We are excited to be working with a leader in the electric industrial vehicle and equipment space, bringing self-driving capabilities to forklifts, which are one of the most ubiquitous material handling vehicles out there.

“Cyngn is pleased to be helping our customers make tangible steps toward achieving their ESG and sustainability goals. In addition to increasing operational efficiencies while enhancing safety measures for employees by implementing self-driving solutions, organizations may also decrease their energy footprint by utilizing electric vehicles, such as Greenland’s electric forklifts, powered by Cyngn technology.

“Another key priority for us is to continue building out our team here at Cyngn, something we believe is critical to the Company’s long-term success. We are focused on ensuring we have the necessary people in place to support the ongoing development, productization and commercialization of EAS, as well as the additional staff needed to support our status as a public company. In the months ahead, we anticipate expanding upon our existing network of key strategic partners allowing us to leverage the strengths, dealer networks, servicing capabilities, and incumbency of organizations that are already ingrained in the material handling space. This will allow us to develop our initial core paying customer base that will serve as the foundational path to recurring revenues.”

GAAP Financial Review

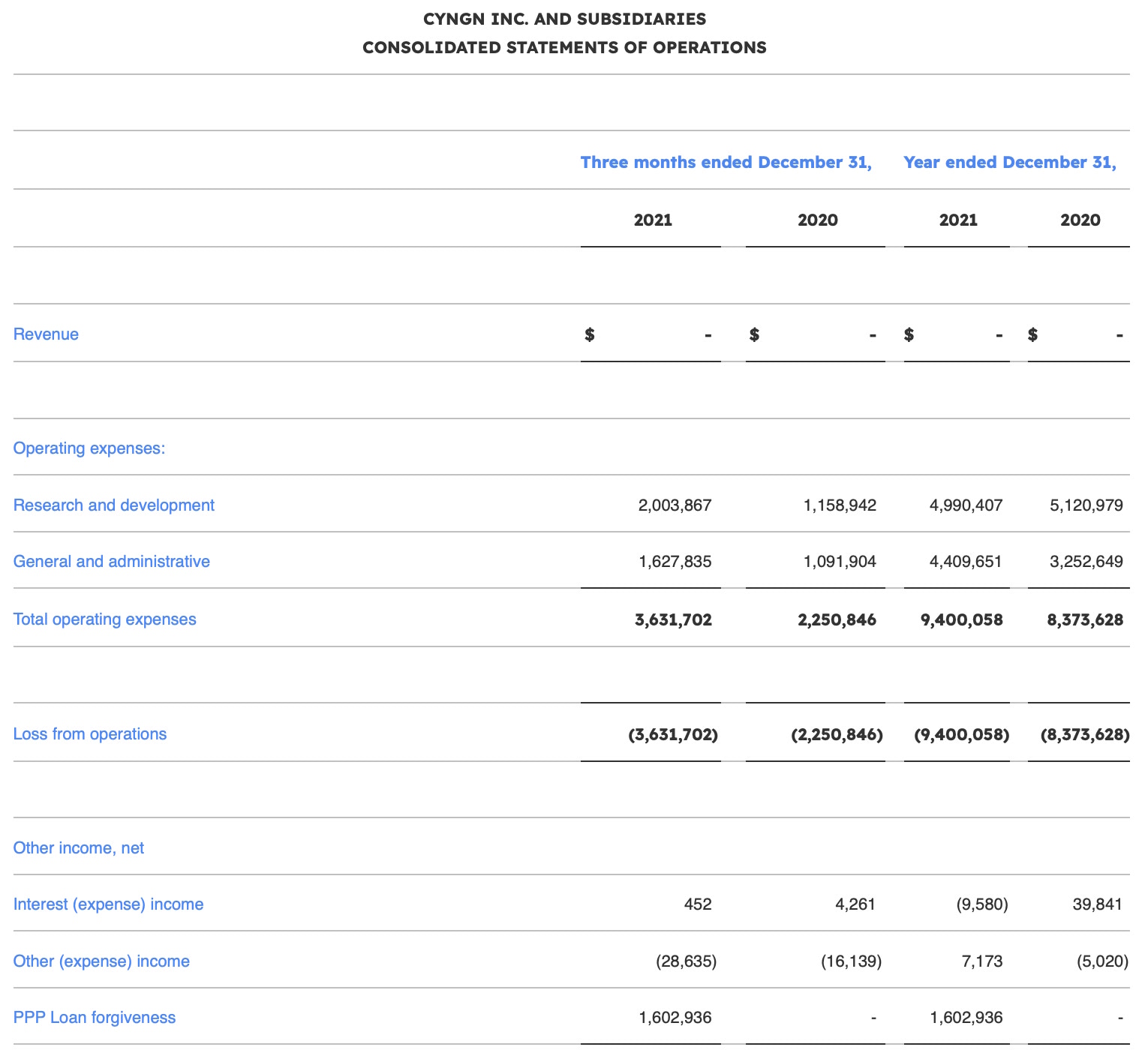

The Company did not generate any revenue for the years ended December 31, 2021, and 2020.

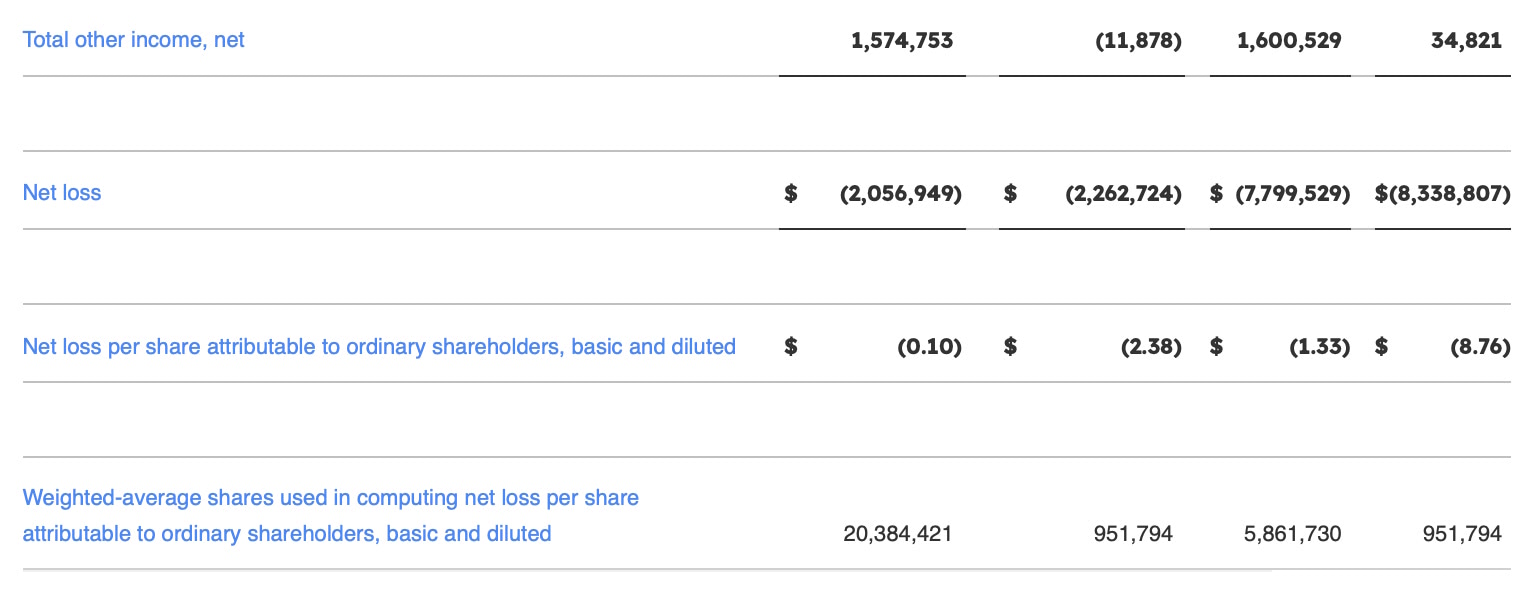

Fourth Quarter Ended December 31, 2021:

- Total operating expenses were $3.6 million for the quarter ended December 31, 2021, compared to $2.3 million in the prior-year quarter. The increase was primarily due to a $0.5 million increase in R&D expense related to costs incurred for additional engineering staff and a $1.1 million increase in general and administrative (“G&A”) expense related to costs incurred for additional personnel and professional services necessary to support becoming a public company. The Company expects R&D costs to continue to increase as it works to restore the appropriate level of engineering and other personnel to support its R&D efforts.

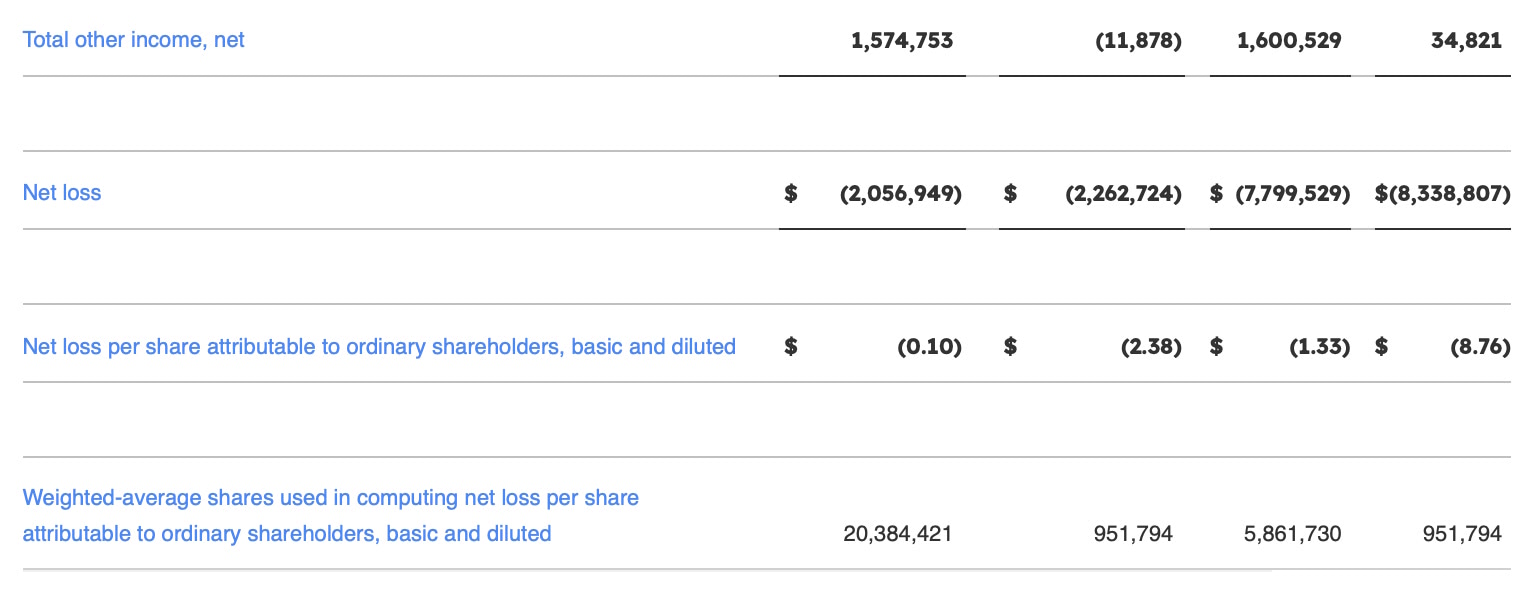

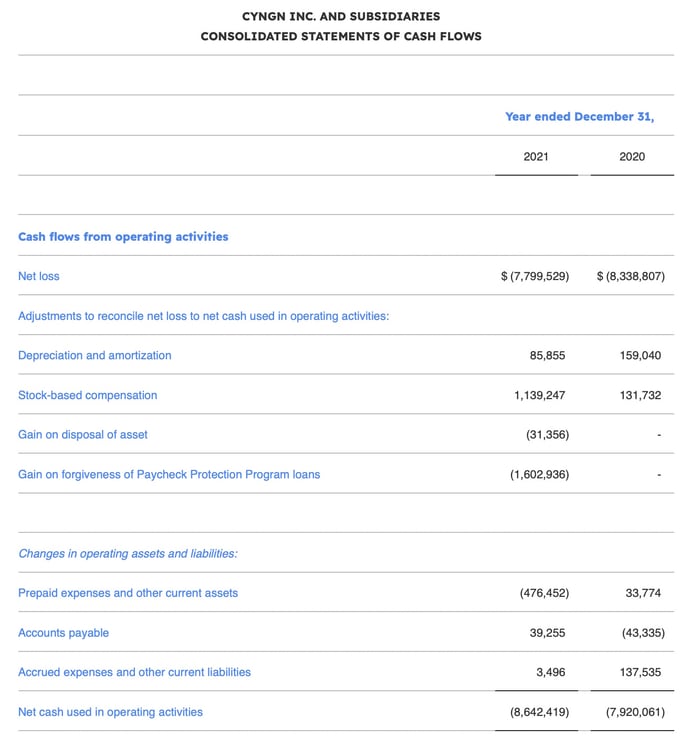

- Net loss was $2.1 million for the quarter ended December 31, 2021, compared to net loss of $2.3 million in the prior-year quarter. The increase in total operating expenses was offset by an increase in other income, which was primarily attributed to the forgiveness of the Paycheck Protection Program (“PPP”) loans by the Small Business Administration (“SBA”) amounting to $1.6 million during the period. Net loss per share on a basic and diluted basis was $0.10 based on approximately 20.4 million weighted average shares for the quarter ended December 31, 2021, compared to net loss per share on a basic and diluted basis of $2.38 per share based on approximately 1.0 million weighted average shares in the prior-year quarter.

Year Ended December 31, 2021:

- Total operating expenses were $9.4 million for the year ended December 31, 2021, compared to $8.4 million in the prior year. The increase was primarily due to a $1.0 million increase in G&A expense related to a $1.0 million increase in stock-based compensation and increased costs incurred for additional personnel and professional services necessary to support the Company’s IPO and becoming a public company, partially offset by a $0.1 million decrease in R&D expense related to a decrease in R&D personnel compared to pre-COVID-19 headcount levels.

- Net loss was $7.8 million for the year ended December 31, 2021, compared to net loss of $8.3 million in the prior year. The decrease was primarily the result of a $1.6 million increase in other income attributed to the forgiveness of the PPP loans by the SBA during the year. Net loss per share on a basic and diluted basis was $1.33 based on approximately 5.9 million weighted average shares for the year ended December 31, 2021, compared to net loss per share on a basic and diluted basis of $8.76 per share based on approximately 1.0 million weighted average shares in the prior year.

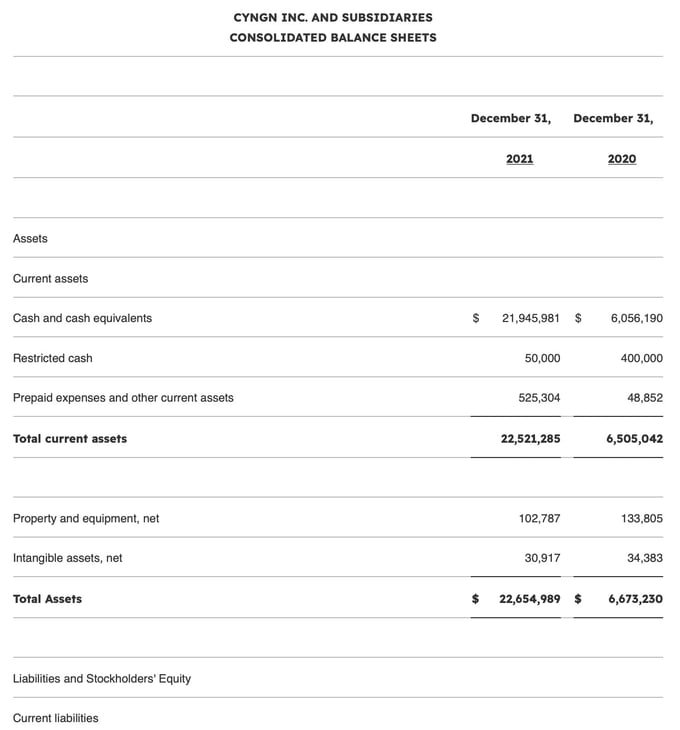

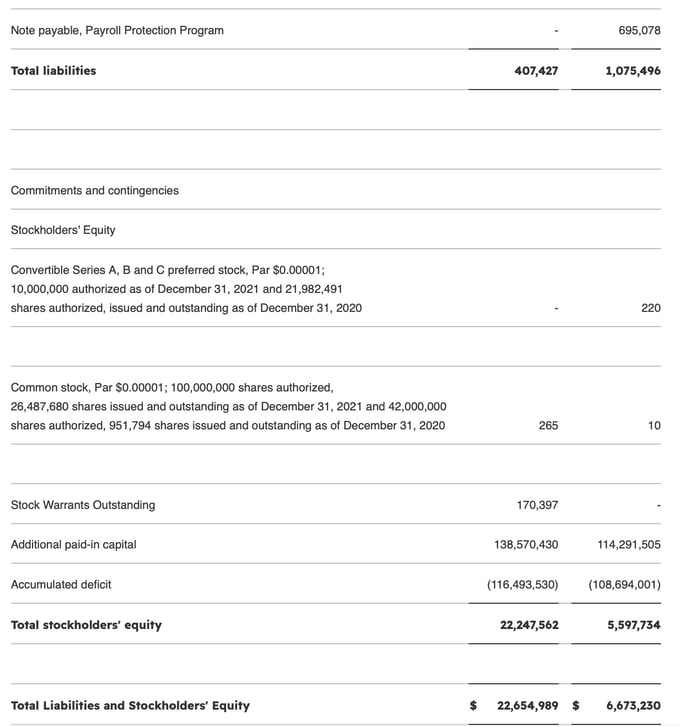

Balance Sheet Highlights:

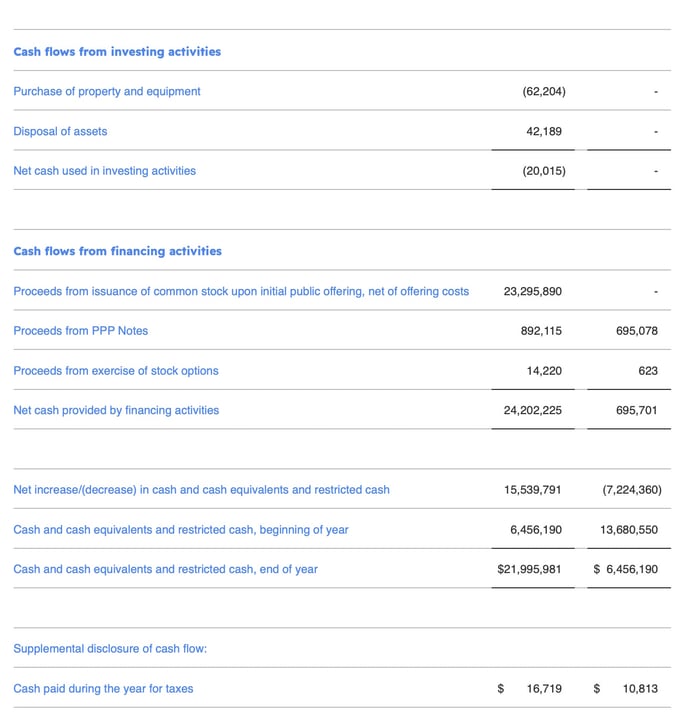

As of December 31, 2021, Cyngn’s cash and cash equivalents were $21.9 million, working capital was $22.1 million, and total stockholders’ equity was $22.2 million; compared to cash and cash equivalents of $6.1 million, working capital of $6.1 million and total stockholders’ equity of $5.6 million, respectively, as of December 31, 2020.

For more details on Cyngn’s financial results for the year ended December 31, 2021, please refer to the Company’s Annual Report on Form 10-K to be filed with the SEC, which will be accessible at www.sec.gov.

Conference Call and Webcast Information:

Cyngn will host a conference call at 2 p.m. PT/5 p.m. ET today (Wednesday, March 23, 2022), during which management will discuss the results of the fourth quarter and year ended December 31, 2021. To participate in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled conference call time:

U.S. & Canada (Toll-Free): (877) 407-9753

International (Toll): (201) 493-6739

The conference call can also be accessed via webcast at the “Events & Presentations” page of Cyngn’s Investor Relations website by clicking here. The Company encourages all participants to also log into the live webcast as it expects to broadcast a short video showcasing its autonomous driving technology in action, customer interviews, long-term vision and more.

Those who are unable to attend the live conference call may access the recording shortly after the conclusion of the call at the above webcast link or at the “Investor Relations” page of the Company’s website (https://investors.cyngn.com/).