MENLO PARK, Calif. Cyngn Inc. (the “Company” or "Cyngn") (NASDAQ: CYN), a developer of innovative autonomous driving software solutions for industrial and commercial applications, today announced its financial results for the second quarter and six months ended June 30, 2022.

Cyngn announces its financial results for the second quarter and six months ended June 30, 2022, after the close of the stock market on August 10, 2022. The Company is also hosting its earnings call that same day. Source: Cyngn

Recent Operating Highlights:

The following operational developments occurred subsequent to June 30, 2022:

- On July 21, 2022, Cyngn announced the launch of its Enterprise Autonomy Suite (“EAS”) v8.0. This latest release includes 138 new features, a 33% reduction in component complexity, and a 75% reduction in cloud computing costs, spanning some 27,000 new lines of code.

- As of July 31, 2022, Cyngn had 62 employees, a net increase of 29 since December 31,2021. This increase is in line with the Company’s plans and the result of recent success in recruiting top talent, primarily in the areas of engineering and product management. Since December 31, 2021, the Company’s research and development (“R&D”) team has grown 126% to 43 members, excluding contractors.

- In July 2022, Cyngn launched a pilot deployment of its autonomous Columbia Stockchaser with Flambeau, Inc. at their 177,000-sq. foot manufacturing facility in Columbus, Indiana. A member of the Nordic Group of Companies, Flambeau specializes in manufacturing and distribution of a variety of products, including toys, sporting goods, and automotive and industrial parts through their various locations in the U.S. and Mexico.

Lior Tal, Cyngn’s CEO, stated, “During the second quarter of 2022, we were focused on continuing to productize our suite of technology products, working closely with our partners on existing and additional deployments. We are thrilled to have launched a pilot deployment with Flambeau, expanding upon our relationship with the Nordic Group, which we believe is a testament to the incredible value our technology and platform have brought to their operations. Insight from these deployments and the effort our development team culminated in our latest release of EAS just three weeks ago: version 8.0. EAS 8.0 is a significant upgrade to its predecessor and an important milestone in commercialization.

“At the end of July, we released a case study quantifying the value that our AV technology brings to Global Logistics and Fulfillment (‘GLF’), a West Coast distribution, fulfillment and 3PL services company. The study reported notable labor cost savings and productivity gains at GLF’s Las Vegas facility where we had deployed an autonomous Stockchaser in late 2021, and the data demonstrated that the higher the throughput of a facility, the greater the potential savings and efficiencies. The value only increases with each vehicle that is made autonomous with Cyngn’s software, platform, and data insights.

“We have continued working to build out our team, particularly in engineering, and are pleased to have filled several key positions in recent months. Our success in hiring will be critical to our ability to continue achieving future milestones. We remain in a strong financial position to move forward with our business initiatives over the next several months and are excited to make greater strides in the remainder of 2022.”

GAAP Financial Review

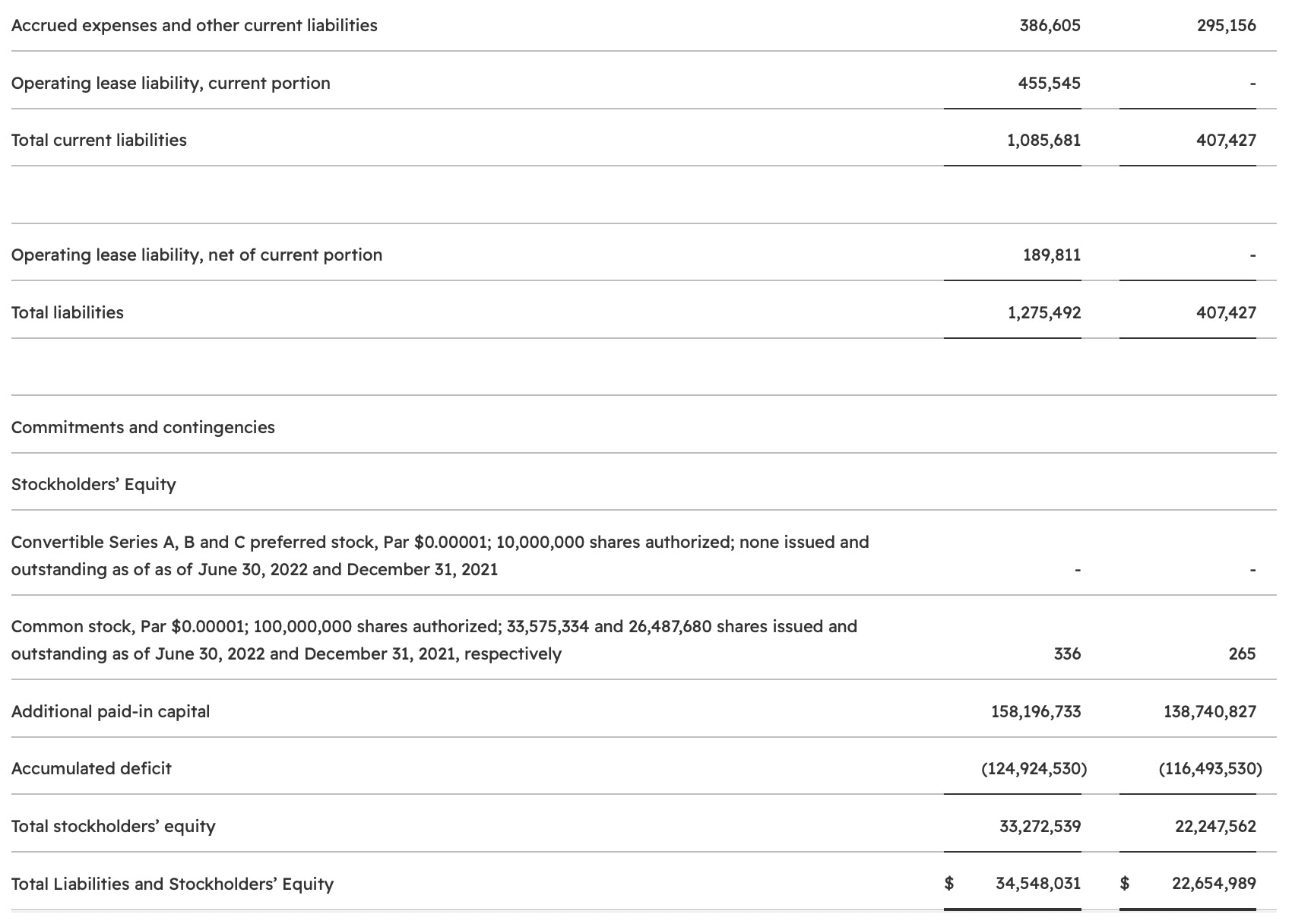

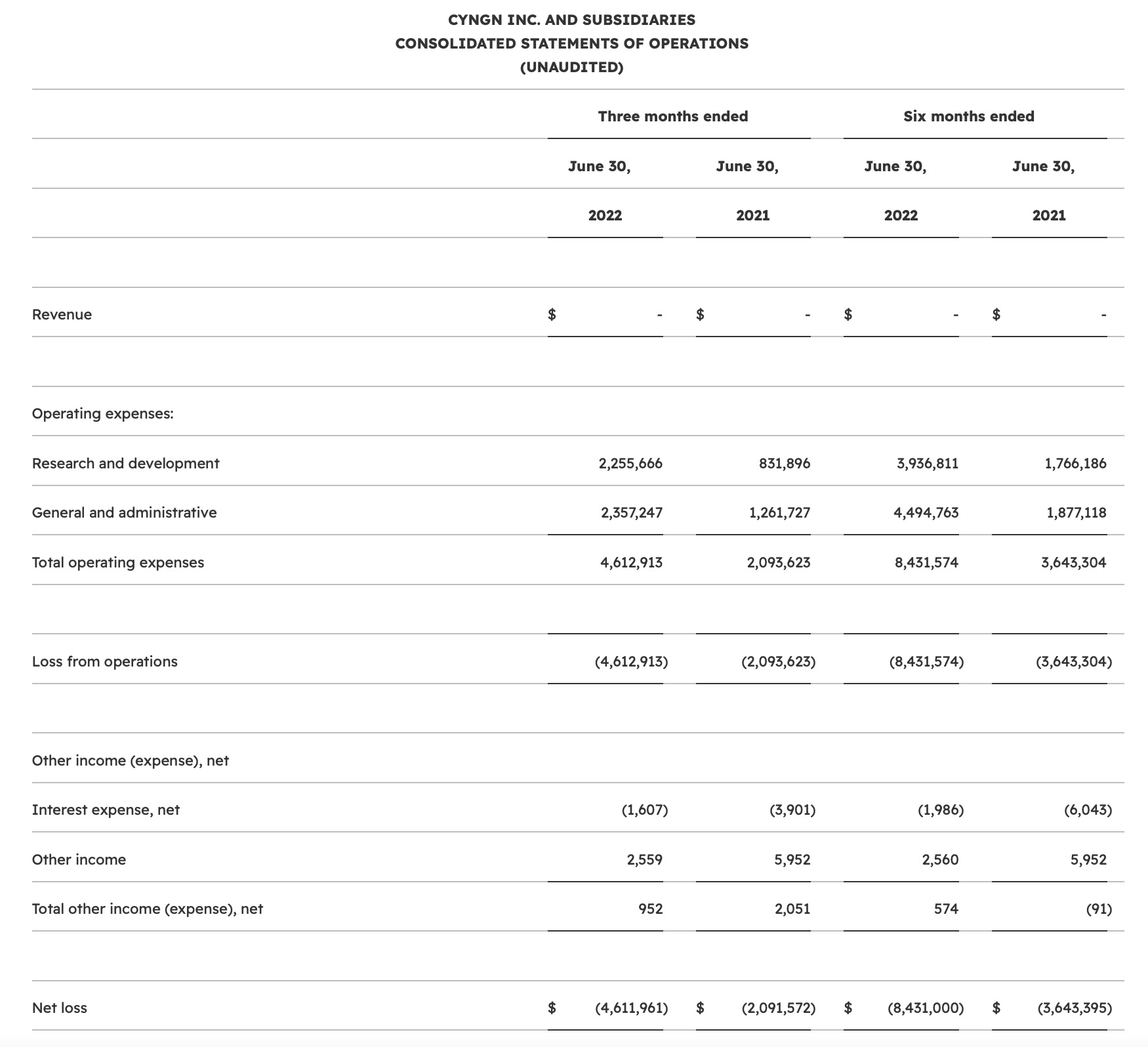

Second Quarter Ended June 30, 2022:

- Total operating expenses were $4.6 million for the quarter ended June 30, 2022, compared to $2.1 million in the prior-year quarter. The increase was primarily due to a $1.4 million increase in R&D expense, which was attributable to significantly increased non-cash, stock-based compensation expense, costs incurred for additional engineering staff and contractors, allocated occupancy costs and R&D-related travel costs. The Company expects R&D costs to continue to increase as it continues to invest in additional engineering and other personnel to support its R&D efforts. General and administrative (“G&A”) expense also increased by $1.1 million due to significantly increased non-cash, stock-based compensation expense, costs incurred for additional personnel and professional services necessary to support becoming a public company and for additional occupancy costs following the renewal of the Company’s lease that expanded the square footage of its Menlo Park offices.

- Net loss was $4.6 million for the quarter ended June 30, 2022, compared to net loss of $2.1 million in the prior-year quarter. Net loss per share on a basic and diluted basis was $0.15 based on approximately 30.7 million weighted average shares outstanding for the quarter ended June 30, 2022, compared to net loss per share on a basic and diluted basis of $2.20 based on approximately 1.0 million weighted average shares outstanding in the prior-year quarter.

Six Months Ended June 30, 2022:

- Total operating expenses were $8.4 million for the six months ended June 30, 2022, compared to $3.6 million in the prior-year period. The increase was primarily due to a $2.6 million increase in G&A expense and $2.2 million increase in R&D expense as explained above.

- Net loss was $8.4 million for the six months ended June 30, 2022, compared to net loss of $3.6 million in the prior-year period. Net loss per share on a basic and diluted basis was $0.29 based on approximately 28.7 million weighted average shares outstanding for the six months ended June 30, 2022, compared to net loss per share on a basic and diluted basis of $3.83 based on approximately 1.0 million weighted average shares outstanding in the prior-year period.

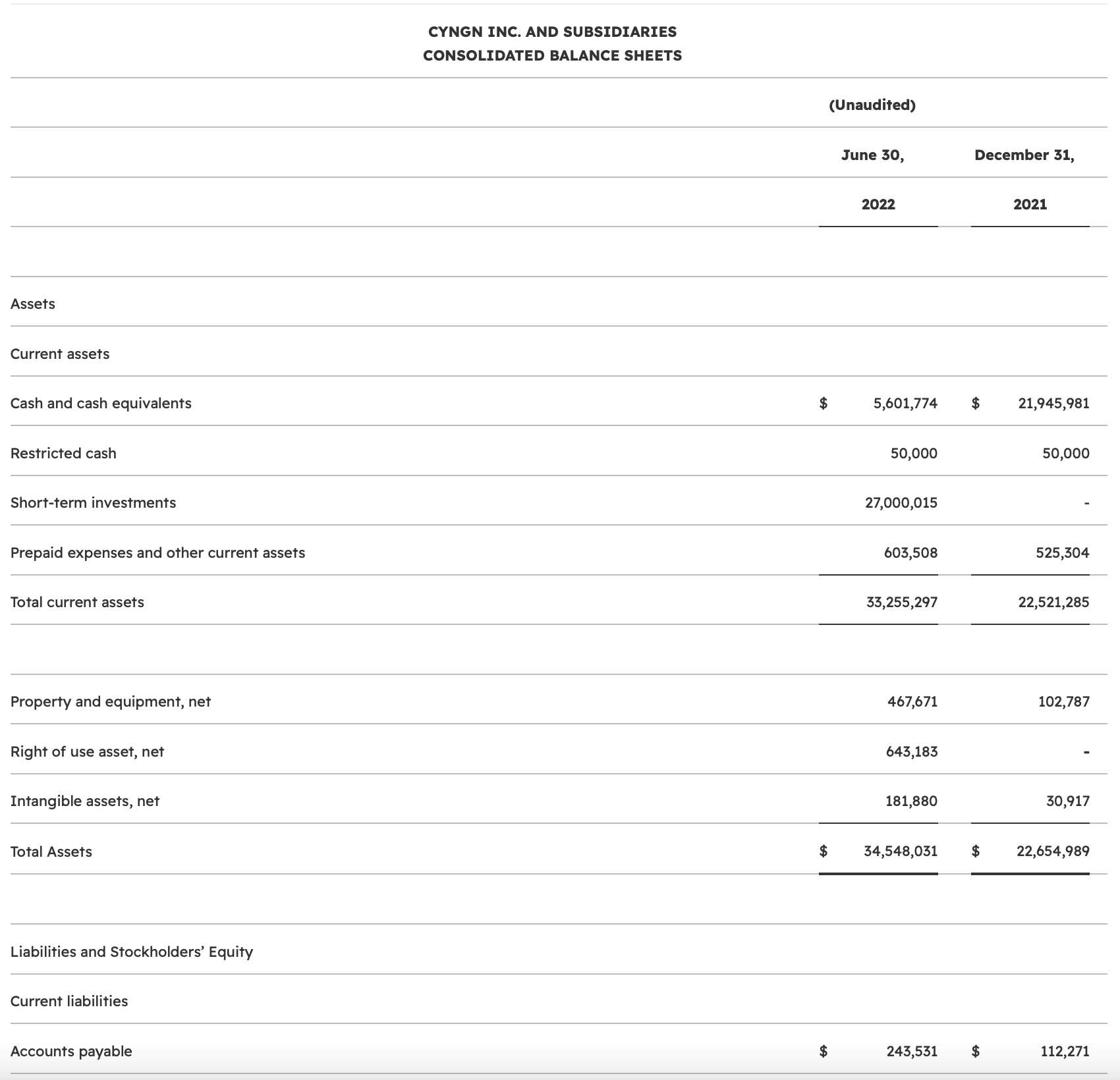

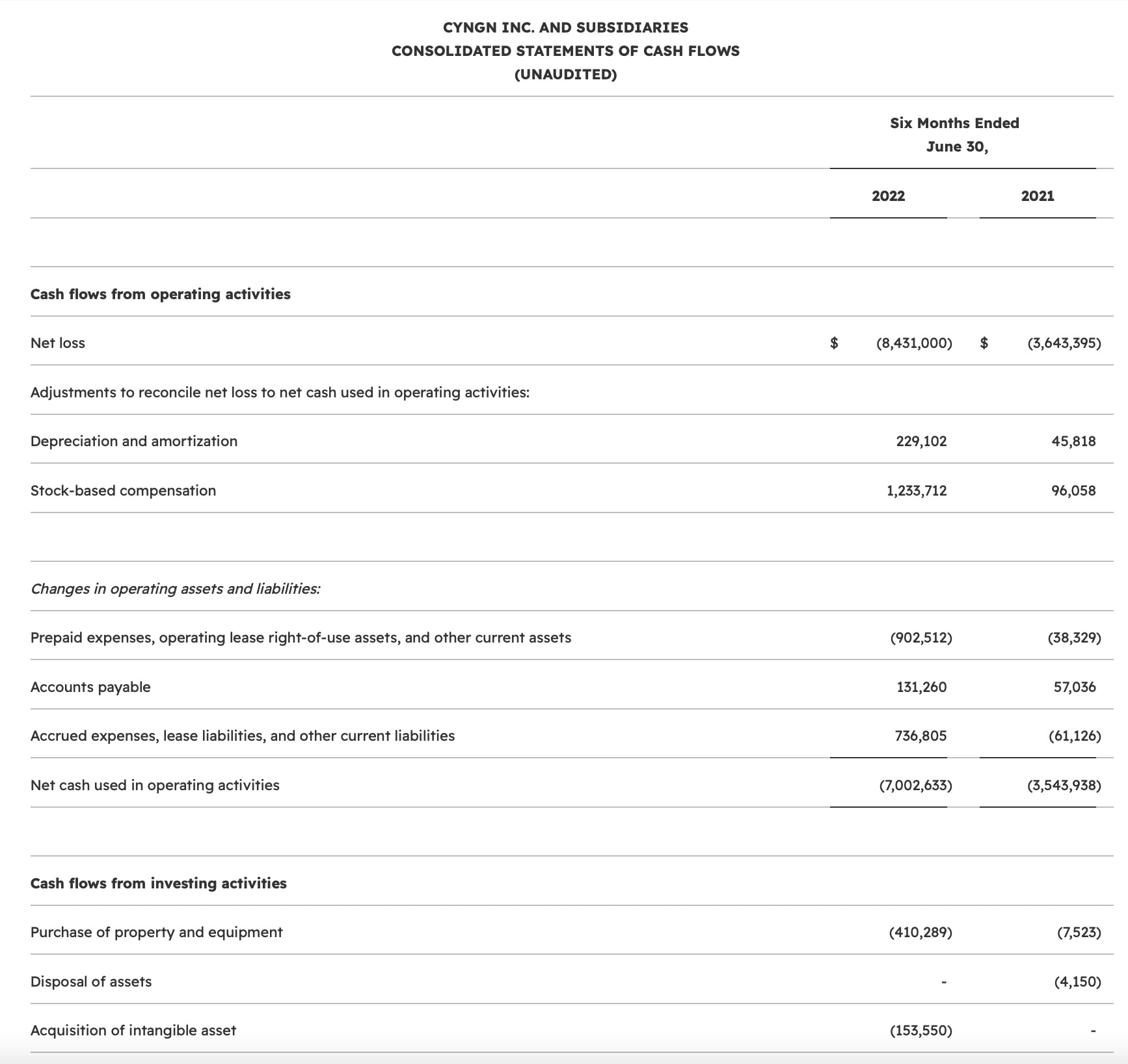

Balance Sheet Highlights:

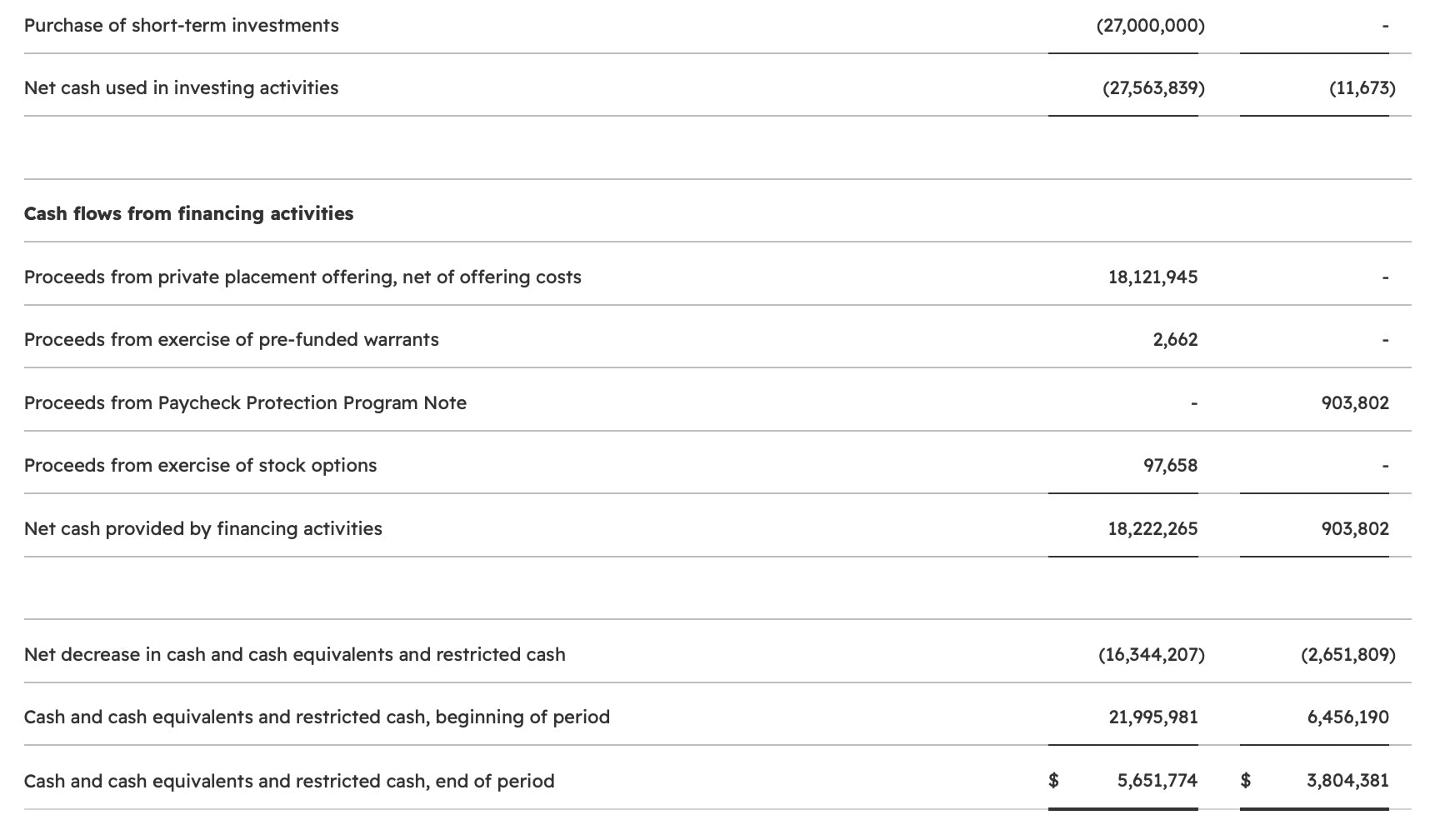

As of June 30, 2022, Cyngn’s cash and cash equivalents and investments in marketable securities were $32.7 million, working capital was $32.2 million, and total stockholders’ equity was $33.3 million; compared to cash and cash equivalents of $21.9 million, working capital of $22.1 million and total stockholders’ equity of $22.2 million, respectively, as of December 31, 2021.

For more details on Cyngn’s financial results for the second quarter and six months ended June 30, 2022, please refer to the Company’s Form 10-Q to be filed with the SEC, which will be accessible at www.sec.gov.

Conference Call and Webcast Information:

Cyngn will host a conference call at 2 p.m. PT/5 p.m. ET today (Wednesday, August 10, 2022), during which management will discuss the results of the second quarter and six months ended June 30, 2022. To participate in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled conference call time:

U.S. & Canada (Toll-Free): (877) 407-9753

International (Toll): (201) 493-6739

The conference call can also be accessed via webcast at the “Events & Presentations” page of Cyngn’s Investor Relations website by clicking here. The Company encourages all participants to also log into the live webcast as it expects to broadcast a short video client testimonial showcasing footage of one of Cyngn’s vehicles being used at a manufacturing facility.

Those who are unable to attend the live conference call may access the recording shortly after the conclusion of the call at the above webcast link or at the “Investor Relations” page of the Company’s website (https://investors.cyngn.com/).

Carolyne Sohn

Vice President, The Equity Group

csohn@equityny.com

(415) 568-2255