MENLO PARK, Calif. Cyngn (or the “Company”) (NASDAQ: CYN), a developer of innovative autonomous driving software solutions for industrial and commercial enterprises, today announced its unaudited financial results for the third quarter ended September 30, 2021.

Background on Cyngn – A Company Targeting Full-scale Commercialization and Recurring Revenue Streams

Cyngn is a pre-revenue company developing the Enterprise Autonomy Suite (“EAS”) that combines advanced in-vehicle autonomous driving technology with leading supporting technologies like data analytics, fleet management, cloud, and connectivity. EAS provides a differentiated solution that the Company believes will drive pervasive proliferation of industrial autonomous vehicles and create value for customers at every stage of their journey towards full automation and the adoption of Industry 4.0.

EAS is currently available as a beta release, and both the components and the combined solution are still under development. Components of EAS have previously been used for a paid customer trial and pilot deployments; EAS is currently available to select beta customers. The Company expects EAS to continually be developed and enhanced according to evolving customer needs, which will take place concurrently while other completed features of EAS are commercialized.

Cyngn expects annual research and development (“R&D”) expenditures in the foreseeable future to equal or exceed that of 2019 and 2020. The Company also expects that limited paid pilot deployments in 2022 and 2023 will offset some of the ongoing R&D costs of continually developing EAS. The Company is targeting for scaled deployments to begin in 2024.

Recent Operating Highlights:

- On October 13, 2021, Cyngn announced its partnership with Columbia Vehicle Group. The partnership marks a key milestone in Cyngn’s roadmap to bringing scalable, secure, and reliable autonomous vehicle technologies to industrial enterprises. The pairing of Cyngn’s DriveMod with Columbia’s fleet of electric utility vehicles means material handling organizations can begin to implement autonomy today, either by retrofitting their existing fleets or by buying new industrial vehicles with DriveMod pre-installed.

- On October 19, 2021, Cyngn’s registration statement on Form S-1 (File No. 333-259278) related to its initial public offering (“IPO”) was declared effective by the U.S. Securities and Exchange Commission (“SEC”). The Company’s common stock began trading on the Nasdaq Capital Market on October 20, 2021. The IPO closed on October 22, 2021. As a result, the Company’s unaudited consolidated financial statements as of September 30, 2021 do not reflect the impact of the IPO, which generated net proceeds of $23.3 million after deducting underwriting discounts, commissions and offering expenses.

Management Commentary:

Lior Tal, Chairman and CEO of Cyngn, stated, “The last three months have been a landmark period in Cyngn’s journey, with the demand for industrial autonomous driving solutions serving as a catalyst for the development of our EAS. Subsequent to the quarter ended September 30, 2021, we were pleased to have successfully completed our IPO with the proceeds being immediately deployed into our daily operations and research and development of EAS. In addition to adding resources to our R&D team, our goal in the coming months will be to further develop our eco-system of partnerships like the one we announced with Columbia Vehicle Group last month and to deploy DriveMod, our end-to-end in-vehicle solution, on the various industrial vehicles of our OEM partners. These partnerships and subsequent beta deployments are key milestones as we work to productize our autonomous vehicle technologies toward full-scale commercialization of EAS.”

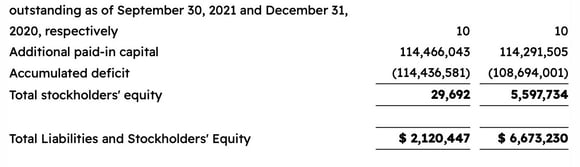

GAAP Financial Review for the Third Quarter Ended September 30, 2021:

- Total operating expenses were $2.1 million for the quarter ended September 30, 2021, compared to $1.8 million in the prior-year quarter. The increase was primarily due to $0.7 million increase in general and administrative (“G&A”) expense related to costs incurred for additional personnel and professional services necessary to support the Company’s IPO and becoming a public company. The increase was partially offset by decreased R&D expense related to a decrease in personnel engaged in the R&D of the Company’s AV technology in 2021 compared to pre-COVID-19 headcount levels. The Company plans to continue to restore the appropriate level of engineering and other personnel to support its R&D efforts and therefore expects R&D costs to increase over time.

- Net loss was $2.1 million for the quarter ended September 30, 2021, compared to net loss of $1.8 million in the prior-year quarter. Net loss per share on a basic and diluted basis was $2.17 for the quarter ended September 30, 2021, compared to net loss per share on a basic and diluted basis of $1.85 per share in the prior-year quarter.

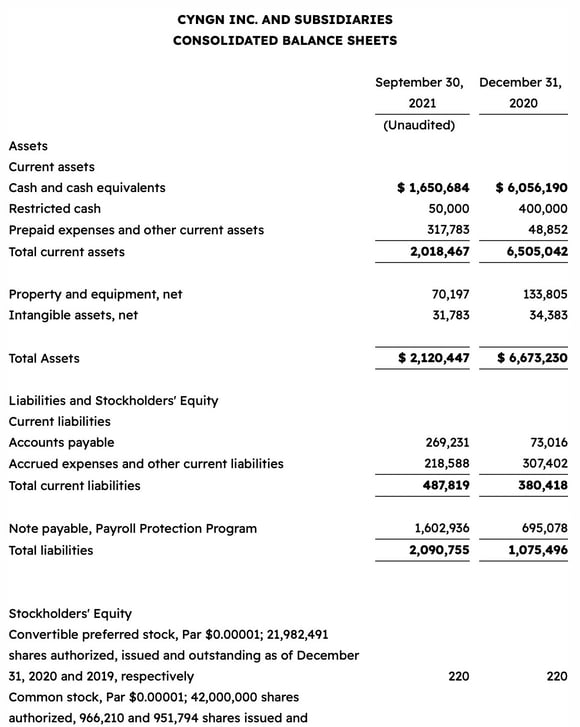

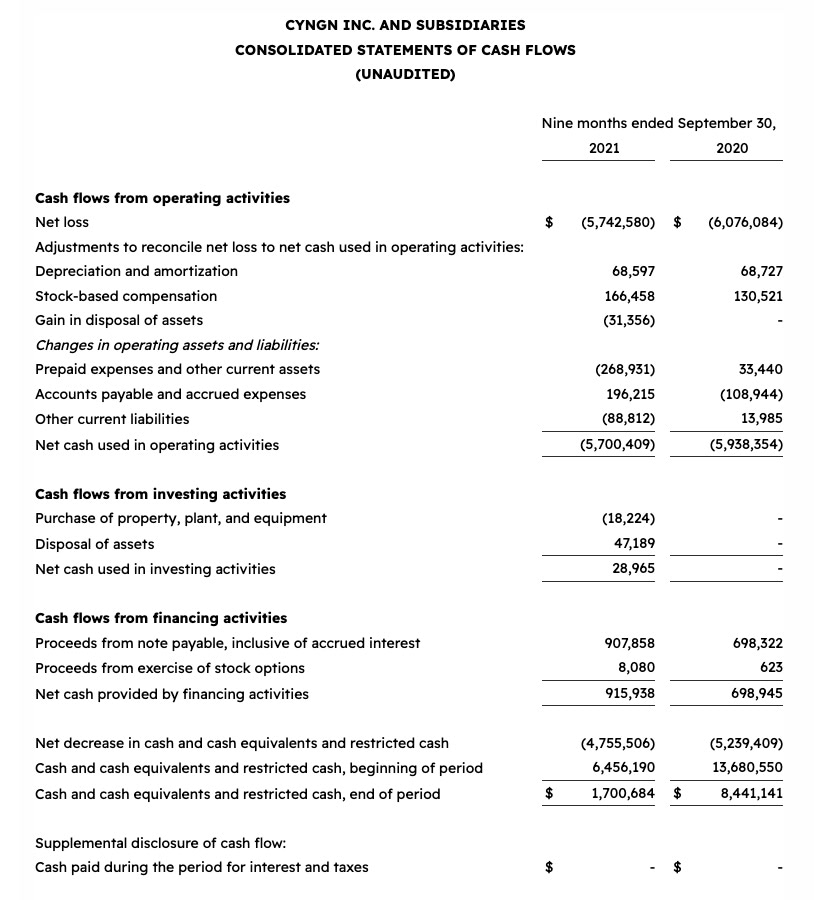

Balance Sheet Highlights:

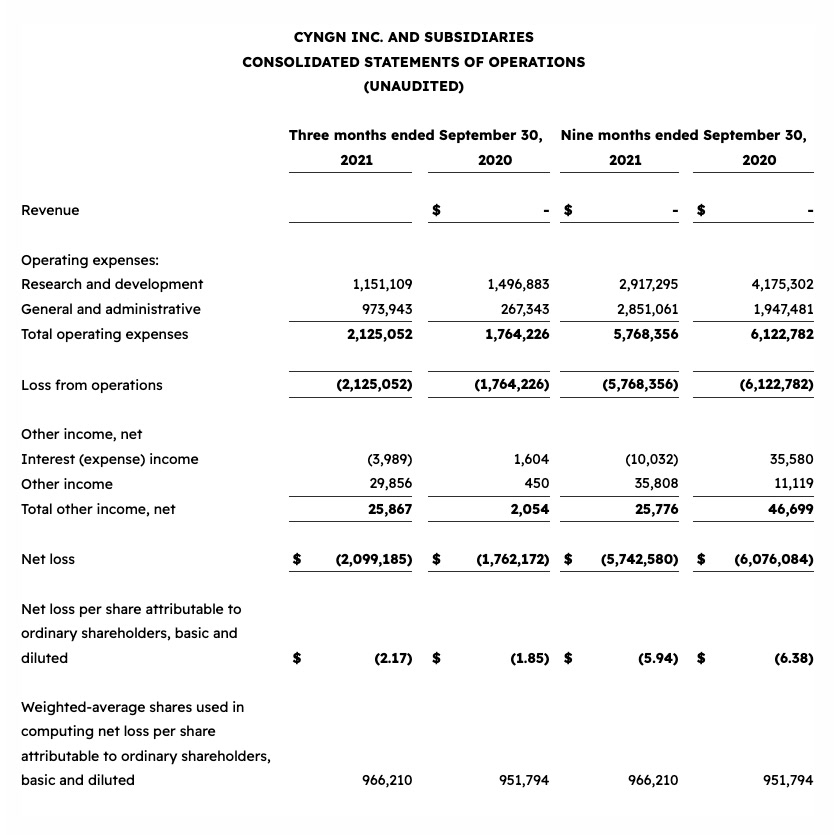

As of September 30, 2021, Cyngn’s cash and cash equivalents including restricted cash were $1.7 million, working capital was $1.5 million, and total stockholders’ equity was $0.03 million; compared to cash and cash equivalents of $6.5 million, working capital of $6.1 million and total stockholders’ equity of $5.6 million, respectively, as of December 31, 2020.

Including the proceeds from the IPO in October 2021, pro forma cash and cash equivalents including restricted cash, working capital and total stockholders’ equity as of September 30, 2021, are $25.0 million, $24.8 million and $23.3 million, respectively.

For more details on Cyngn’s financial results for the quarter ended September 30, 2021, please refer to the Company’s Quarterly Report on Form 10-Q to be filed with the SEC, which is accessible at www.sec.gov.

Conference Call and Webcast Information:

Cyngn will host a conference call at 2 p.m. PT/5 p.m. ET today (Wednesday, November 17, 2021), during which management will discuss the results of the third quarter ended September 30, 2021. To participate in the conference call, please use the following dial-in numbers about 5 minutes prior to the scheduled conference call time:

U.S. & Canada (Toll-Free): +1 (877) 407-9753

International (Toll): +1 (201) 493-6739

The conference call can also be accessed via webcast at: https://78449.themediaframe.com/dataconf/productusers/cyn/mediaframe/47383/indexl.html.

Those who are unable to attend the live conference call may access the recording shortly after the conclusion of the call at the above webcast link or at the “Investor Relations” page of the Company’s website (https://investors.cyngn.com/).