MENLO PARK, Calif., November 8, 2023. – Cyngn Inc. (the “Company” or “Cyngn”) (Nasdaq: CYN), a developer of AI-powered autonomous driving software solutions for industrial applications, today announced its financial results for the fiscal third quarter ended September 30, 2023.

Recent Operating Highlights:

“We’ve achieved a number of impressive successes in both the third quarter and in October, and we anticipate continued business momentum through the end of the fiscal year,” said Lior Tal, Chairman and Chief Executive Officer of Cyngn. “Most notably, I am very pleased with the results of the DriveMod Stock chaser deployment at a North American facility for a Fortune 100 customer, the DriveMod Tugger debut with our partner Motrec’s MT160 vehicle, and the identification of the Arauco South Carolina site for our DriveMod Forklift rollout in mid-2024 as these achievement are pivotal in the commercialization of EAS (Enterprise Autonomy Suite) and signal market acceptance of our ever-advancing product suite for industrial automation. Additionally, our recent dealer network launch will further expand our customer base as we scale deployments in 2024.”

Q3 2023 Financial Review:

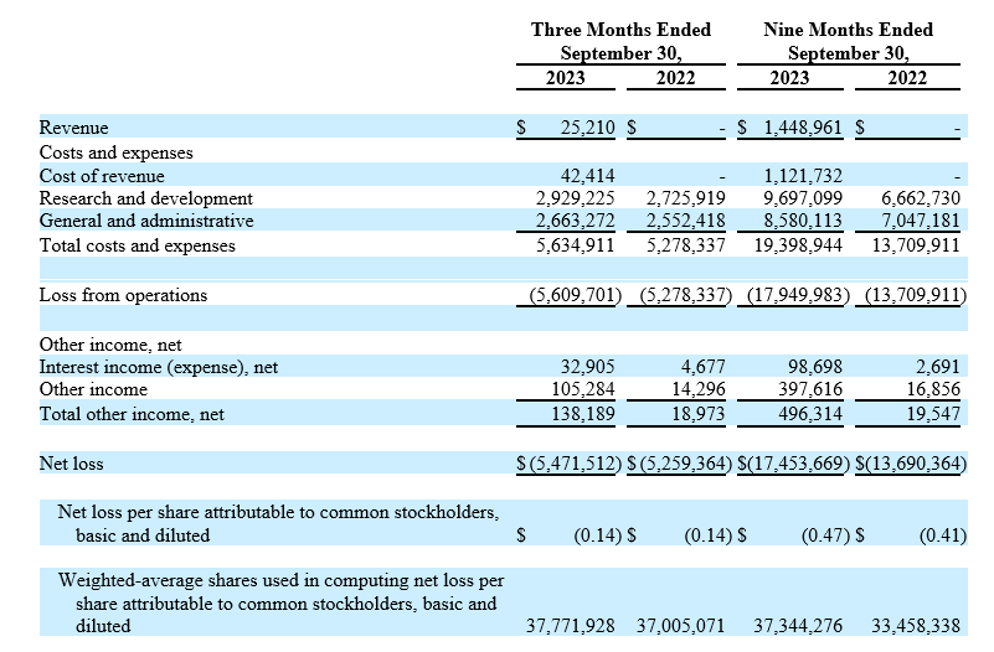

- Third quarter revenue was $25.2 thousand compared to no revenues in the third quarter of 2022. Third quarter revenue was derived for the first time from EAS software subscriptions from DriveMod Stock chaser vehicle deployments.

- Total costs and expenses in the third quarter were $5.6 million, an increase from $5.3 million in the third quarter of 2022. This increase was primarily due to costs incurred for bringing up initial customer vehicle deployments, costs related to increased headcount in both R&D and G&A, as well as modest increases in other operating expenses. Increased R&D expense was offset by the first-time capitalization of internally developed software. Headcount is currently at 72, up from 64 employees at the end of the third quarter of 2022.

- Net loss for the third quarter was $(5.5) million compared to $(5.3) million in the corresponding quarter of 2022. Third quarter 2023 net loss per share was $(0.14), based on basic and diluted weighted average shares outstanding of approximately 37.8 million in the quarter. This compares to a net loss per share of $(0.14) in the third quarter of 2022, based on approximately 37.0 million basic and diluted weighted average shares outstanding.

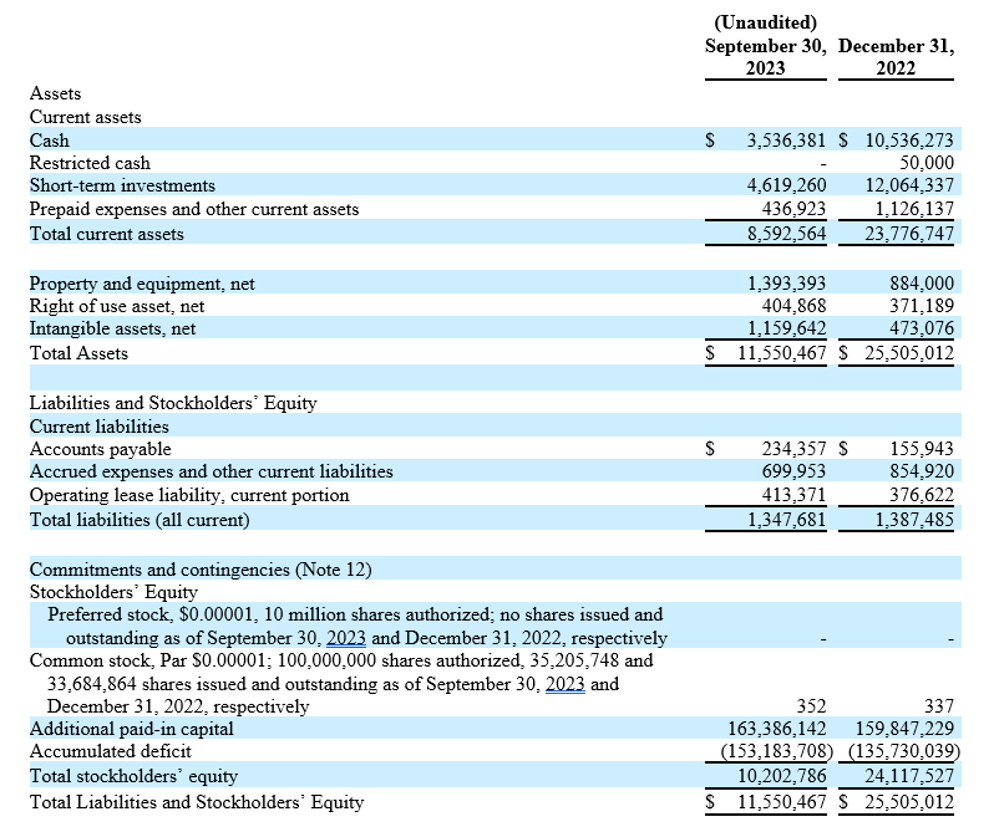

Balance Sheet Highlights:

Cyngn’s unrestricted cash and short-term investments at the end of the third quarter of 2023 total $8.2 million compared to $22.6 million as of December 31, 2022. At the end of the same period, working capital was $7.2 million and total stockholders’ equity was $10.2 million, as compared to year-end working capital of $22.4 million and total stockholders’ equity of $24.1 million, respectively as of December 31, 2022.

For more information on Cyngn, visit the “Investor Relations” page of the Company’s website (https://investors.cyngn.com/).

CYNGN INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Unaudited)

CYNGN INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

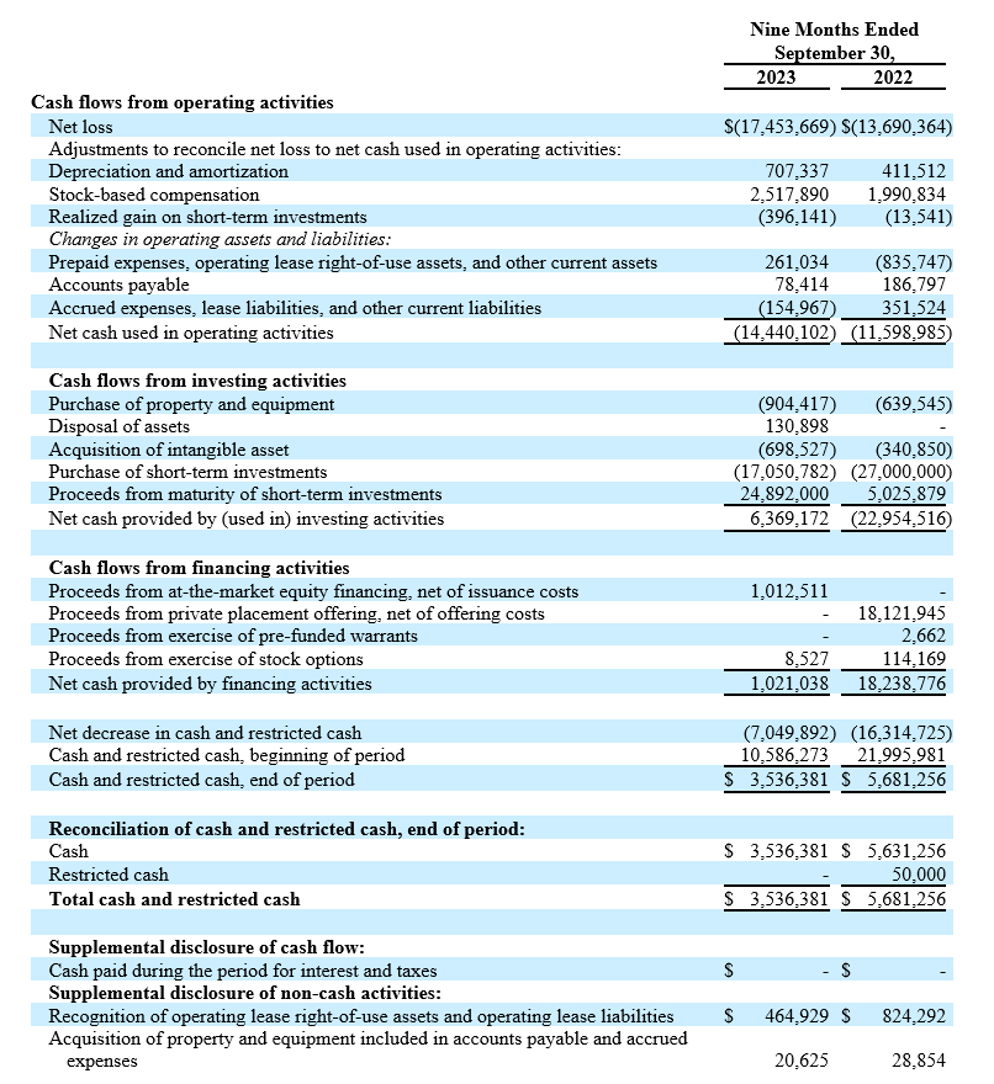

CYNGN INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited)